Irs Method Or Tax Court Method

Here are some of the images for Irs Method Or Tax Court Method that we found in our website database.

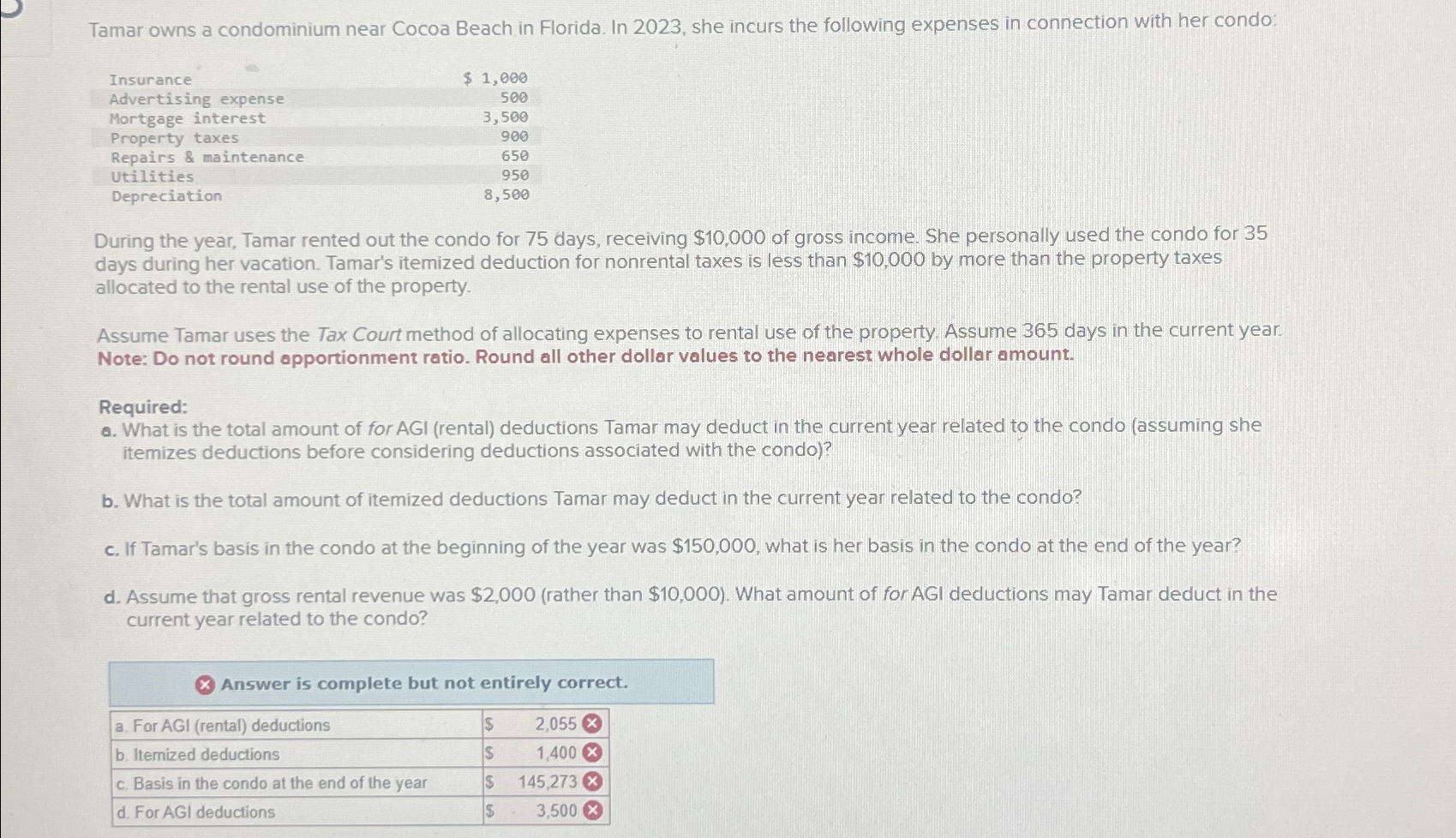

Please use TAX COURT METHOD not Irs method Chegg com

Where do I find out which method(irs vs tax court method) I used in

Where do I find out which method(irs vs tax court method) I used in

Where do I find out which method(irs vs tax court method) I used in

Tax refund method : r/IRS

IRS Revises Form for Accounting Method Change Requests Tax Notes

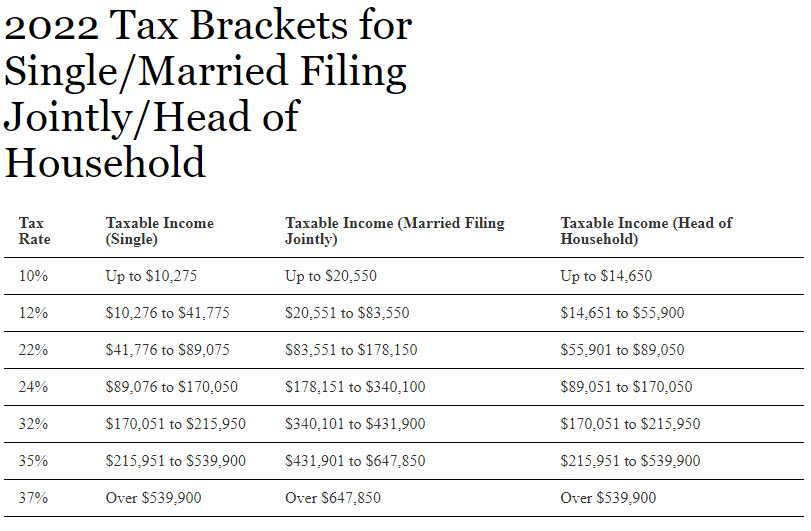

2022 Tax Changes Method CPA

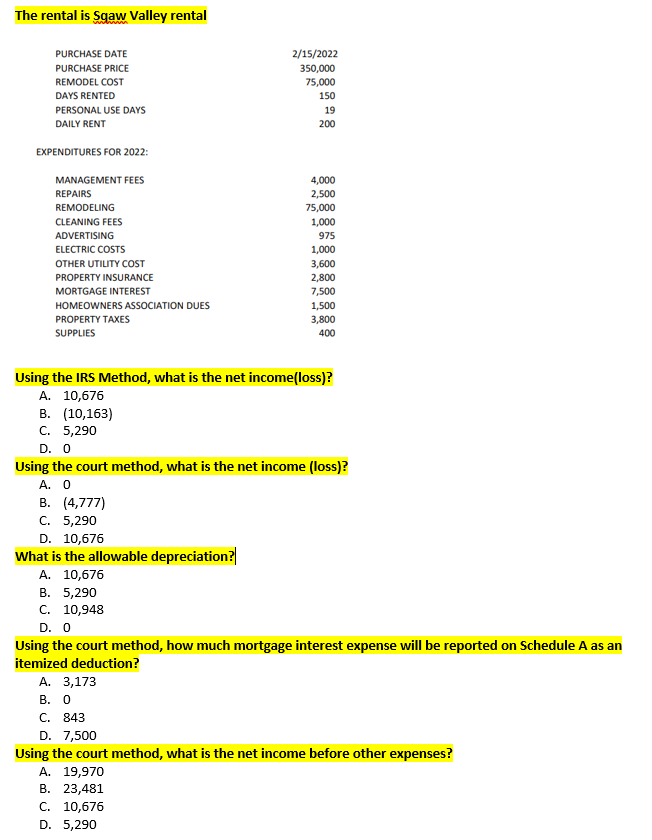

Using the IRS Method what is the net income(loss)? Chegg com

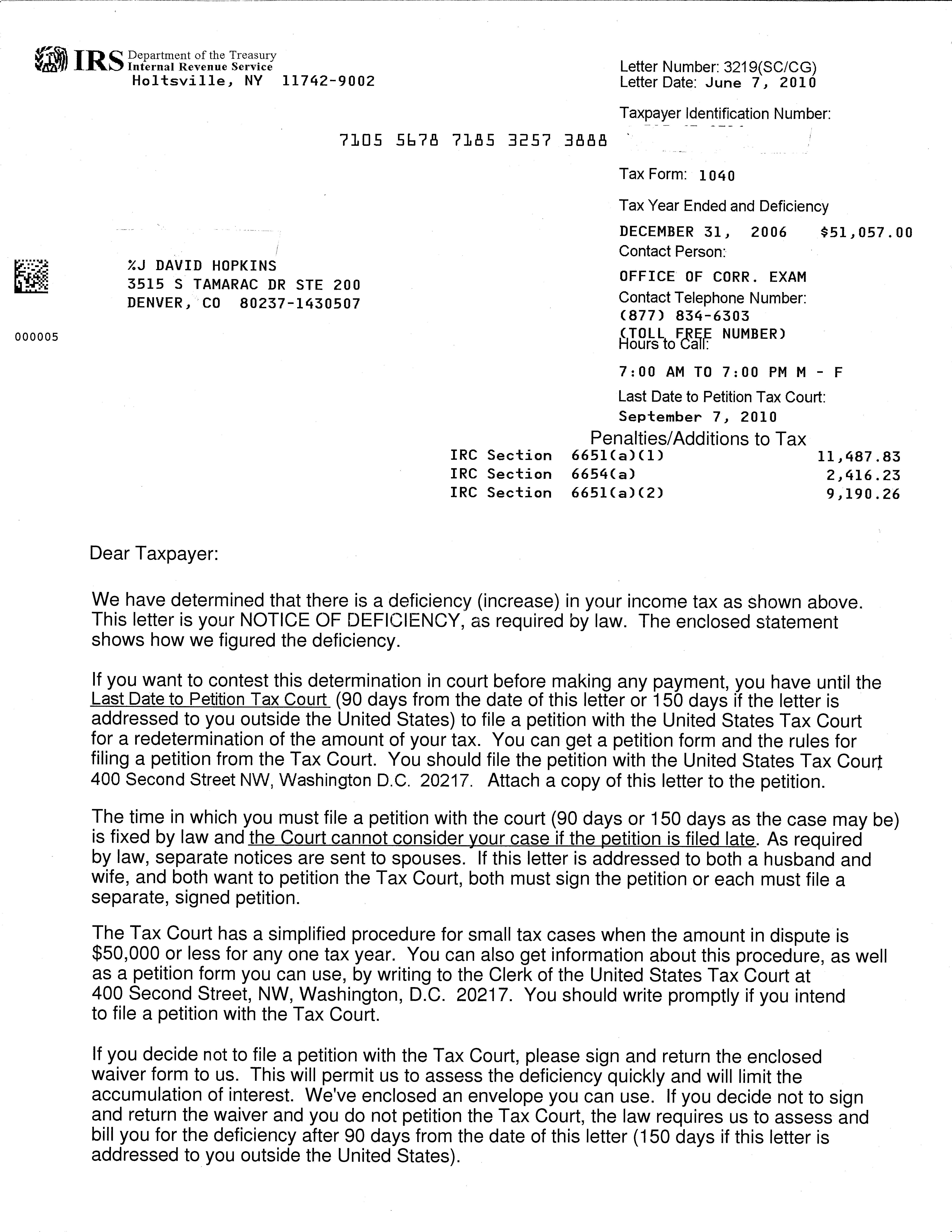

Audit Letter 3219 Tax Attorney Response to the IRS TaxHelpAudit com

:max_bytes(150000):strip_icc()/taxcourt.asp-final-3461fc38e9cd4b64949a87524ade55bf.png)

Tax Court: What It Is How It Works Trial Procedures

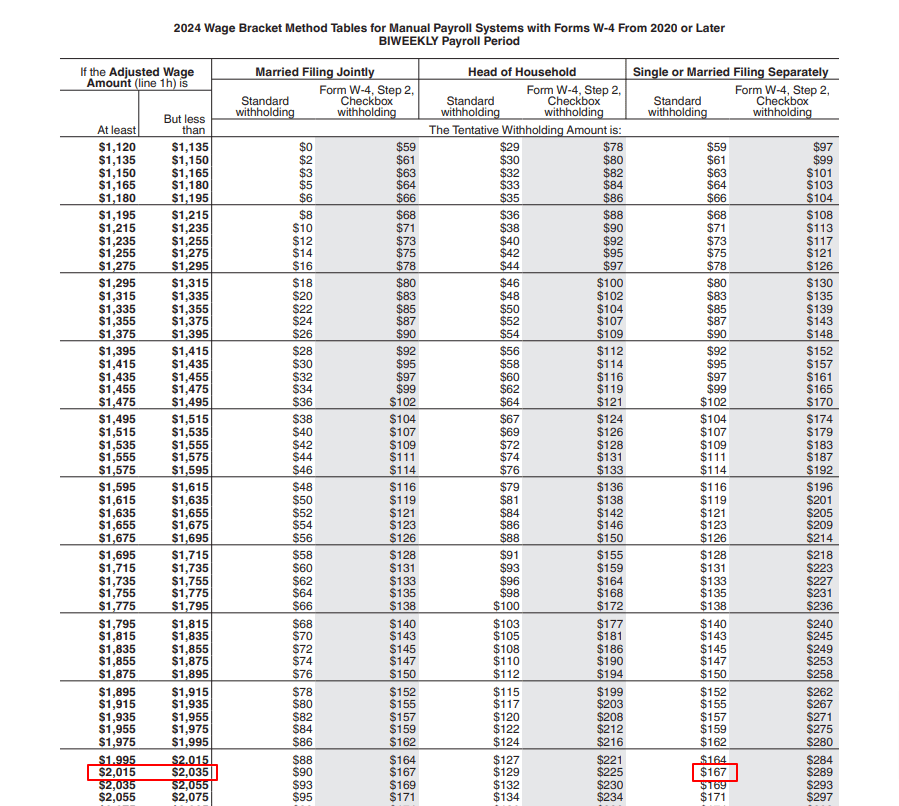

Updated Income Tax Withholding Tables for 2024: A Guide Worksheets

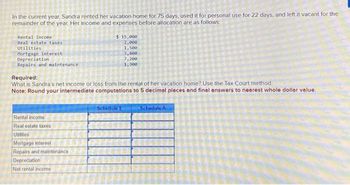

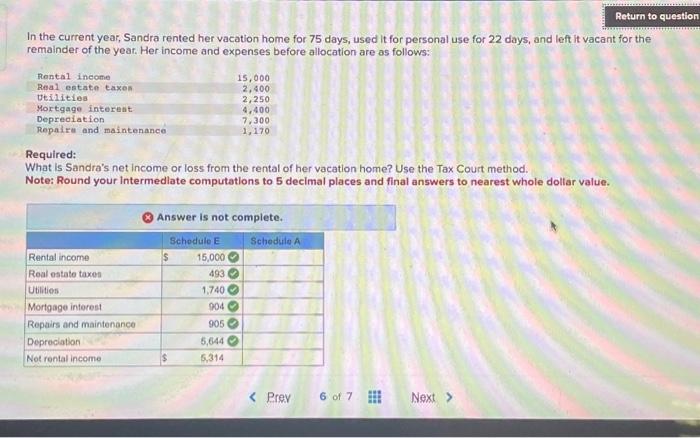

Answered: What is Sandra #39 s net income or loss from the rental of her

IRS Form 8866 Instructions Interest Under the Look Back Method

IRS Form 8697 Instructions Interest Under the Look Back Method

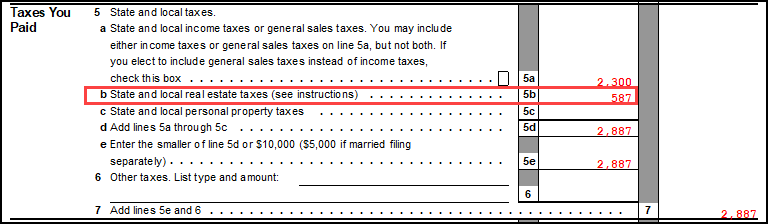

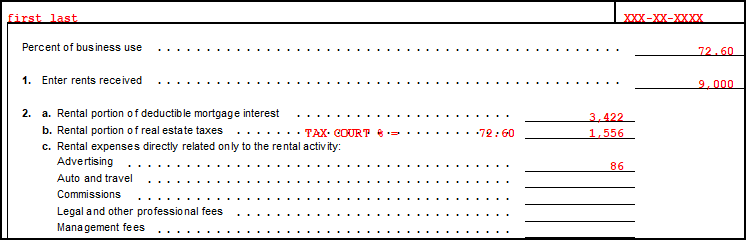

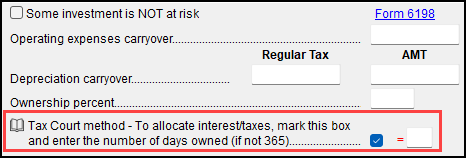

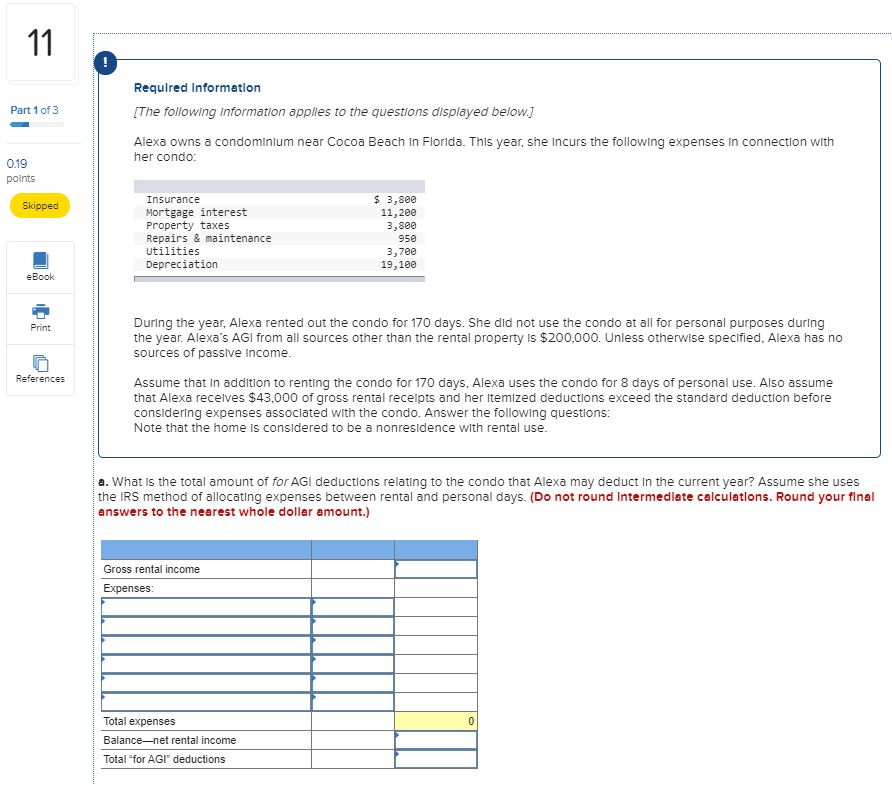

Drake Tax 1040 Schedule E Tax Court Method Election

Drake Tax 1040 Schedule E Tax Court Method Election

Drake Tax 1040 Schedule E Tax Court Method Election

Drake Tax 1040 Schedule E Tax Court Method Election

Nebraska income tax brackets 2021 handkoti

Student Loan Interest Deduction Worksheet Walkthrough (IRS

Student Loan Interest Deduction Worksheet Walkthrough (IRS Schedule 1

Real Estate Investment Rental Property Tax Matters WCG CPAs Advisors

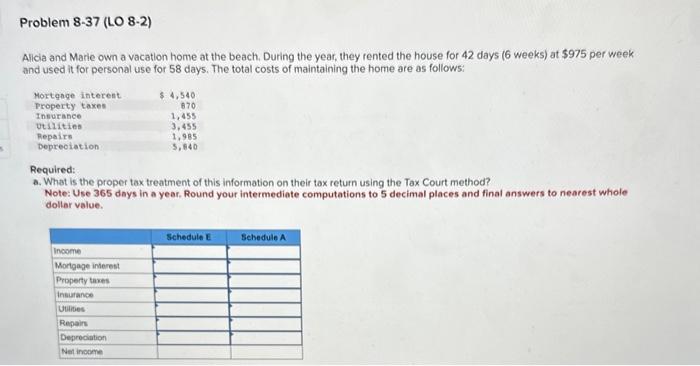

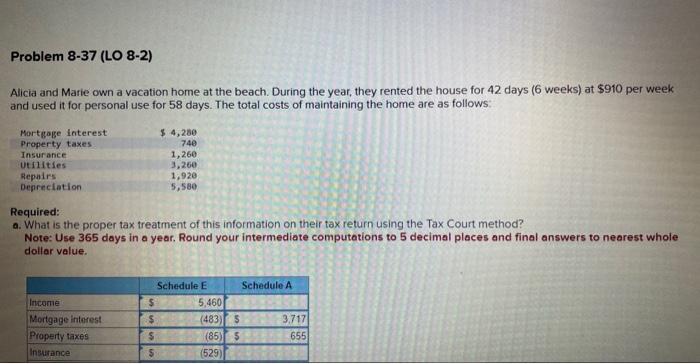

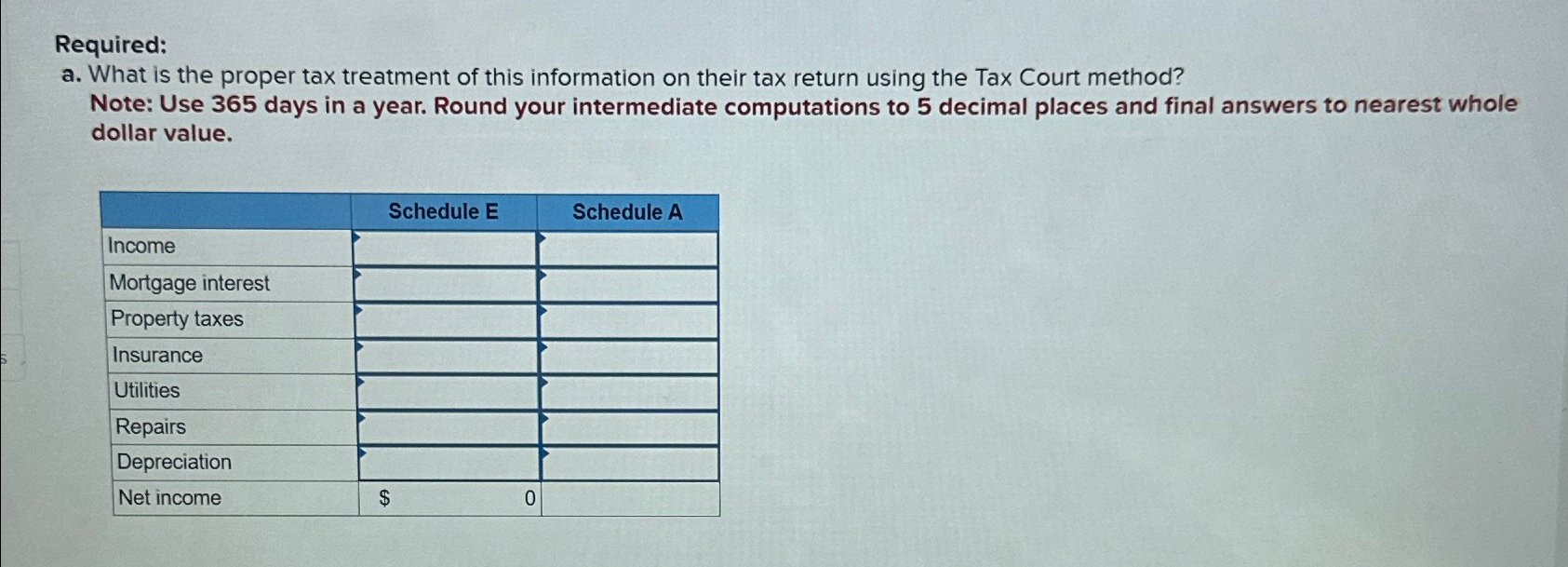

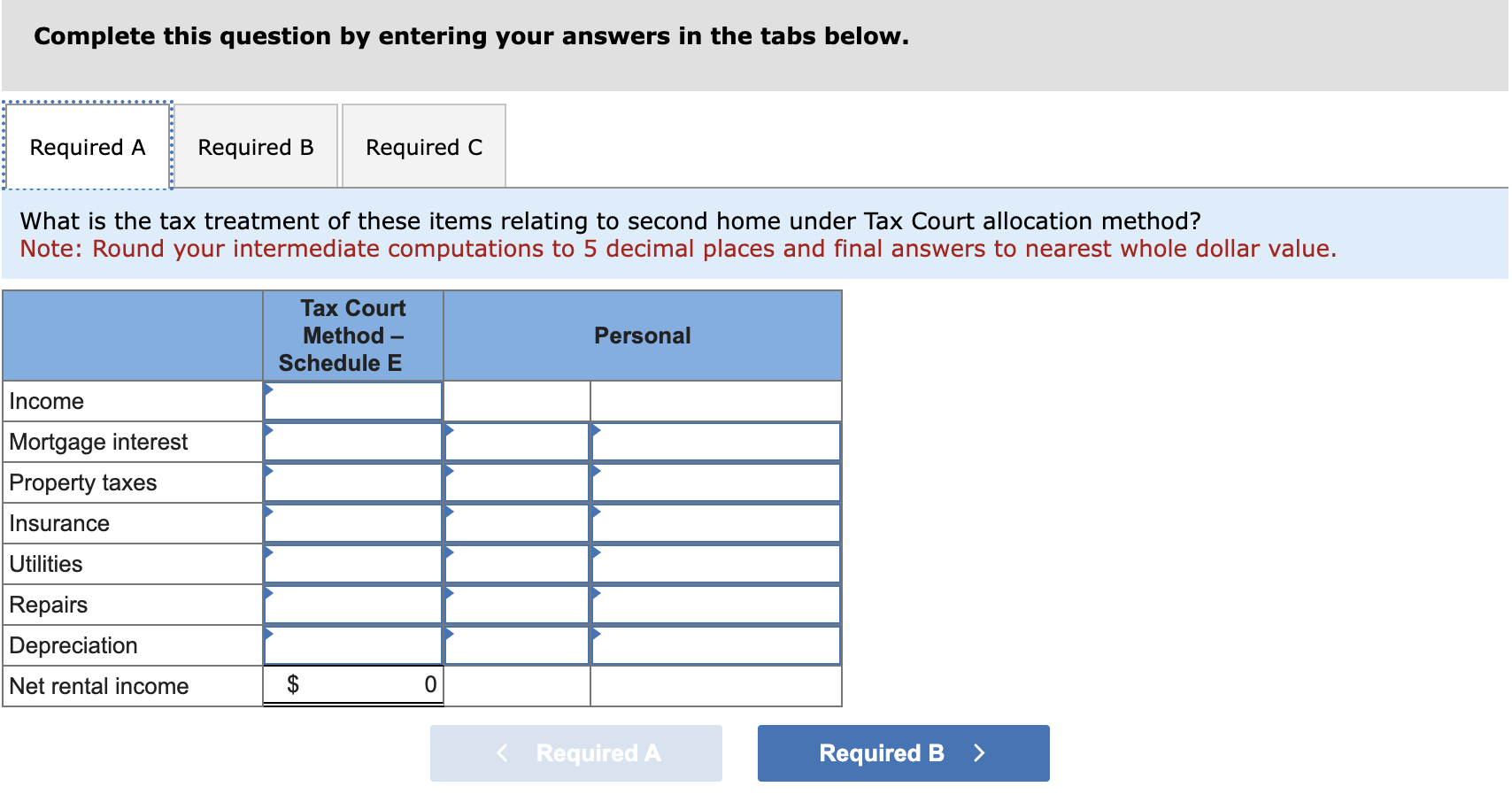

Answered: Required: a What is the proper tax bartleby

Anchor Tax Service Home use worksheet Worksheets Library

Answered: Required: a What is the proper tax treatment of this

Vacation home rentals and the TCJA Journal of Accountancy

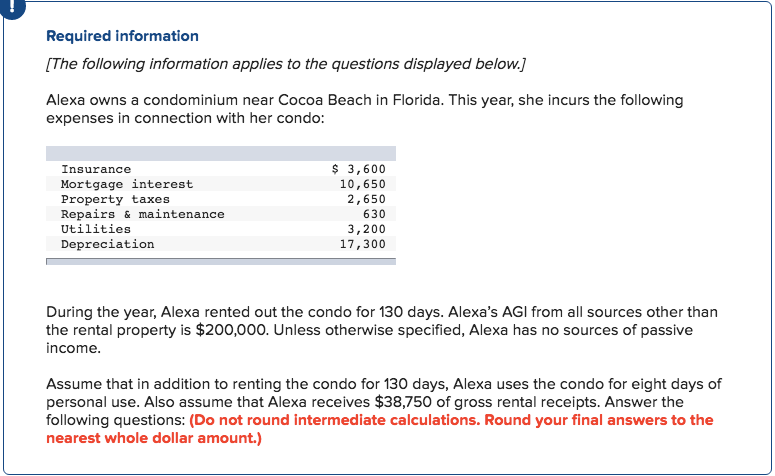

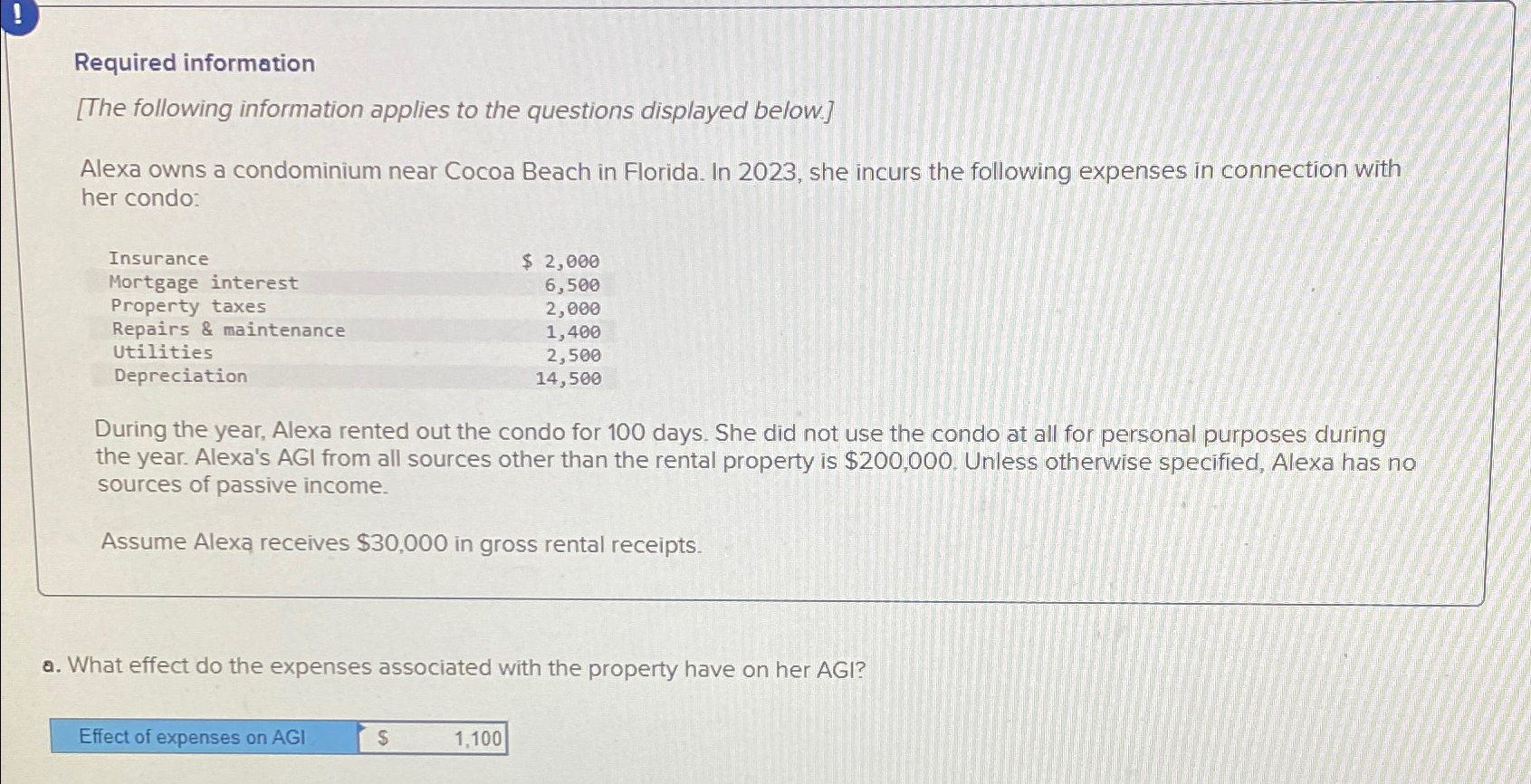

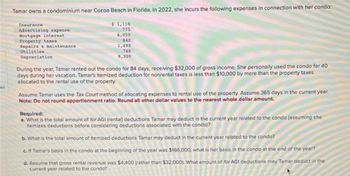

Solved Required informatio The following information Chegg com

Solved Required informatio The following information Chegg com

Solved b What is the total amount of from AGI deductions Chegg com

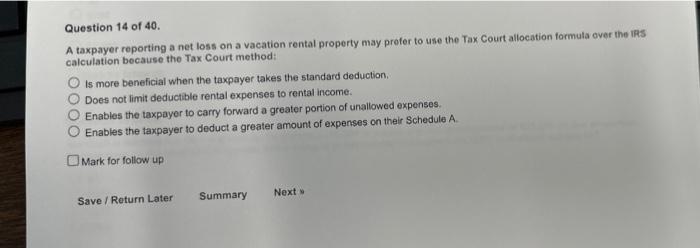

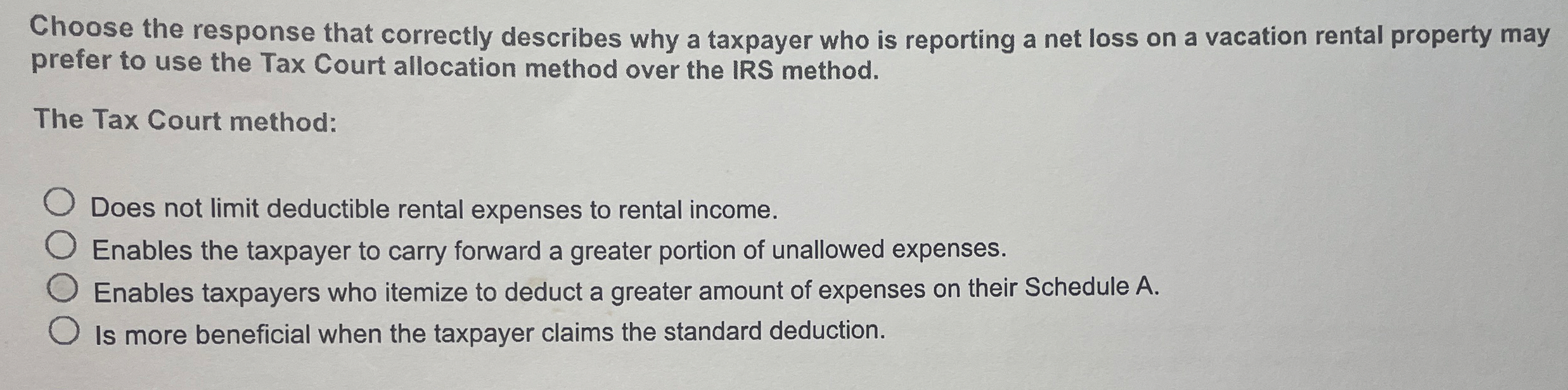

Solved Question 14 of 40 A taxpayer reporting a net loss on Chegg com

What Is The Tax Court Method? CountyOffice org YouTube

Is Verbal Abuse Domestic Violence? CountyOffice org YouTube

Appeals Process

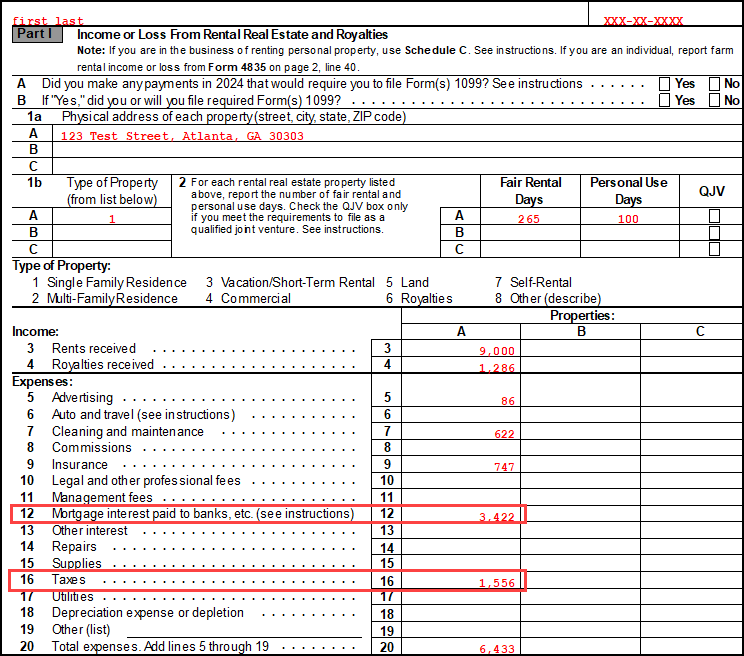

Schedule E Worksheet: Simplify Your Tax Reporting Process

Free QuickBooks IRS 1040 Schedule E Template for Google Sheets

62 docx Question: Assume Natalie uses the Tax Court method of

Vacation Home Tax Rules Bolton Method WCG CPAs Advisors

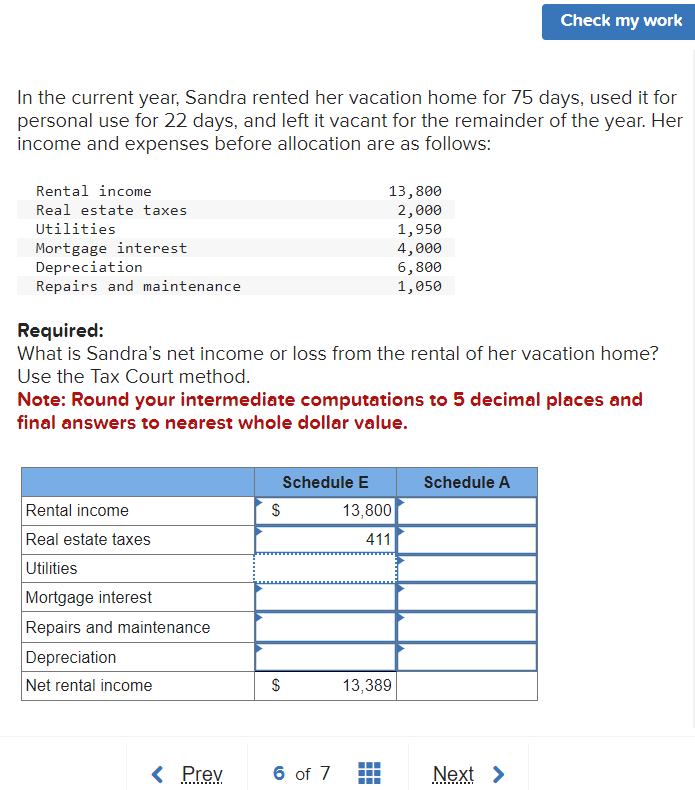

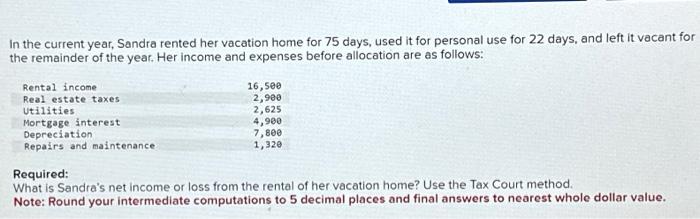

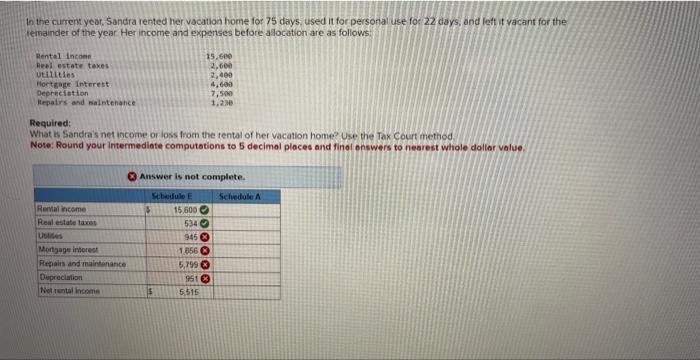

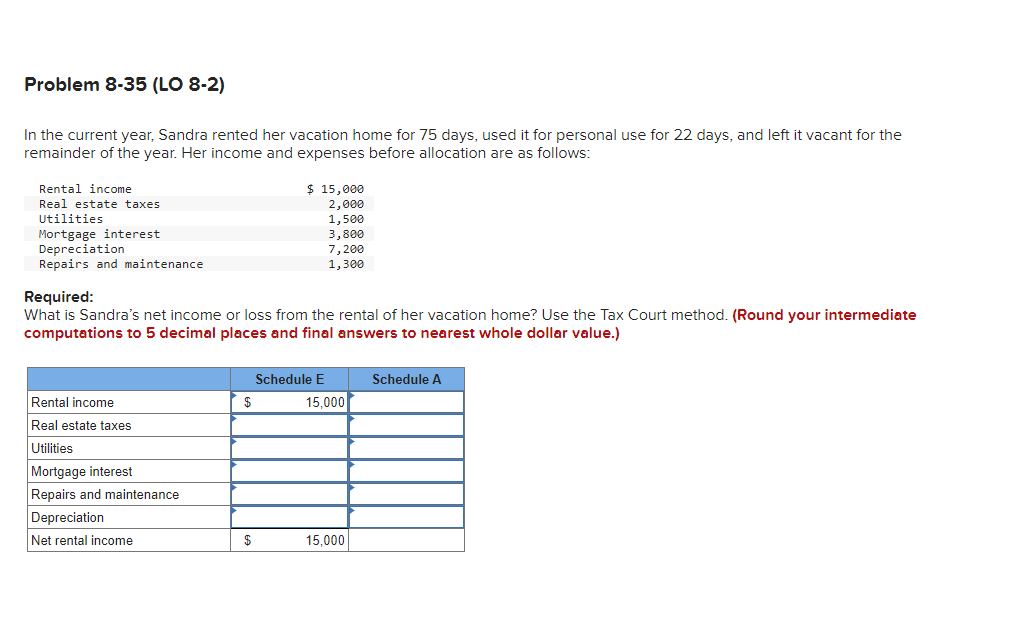

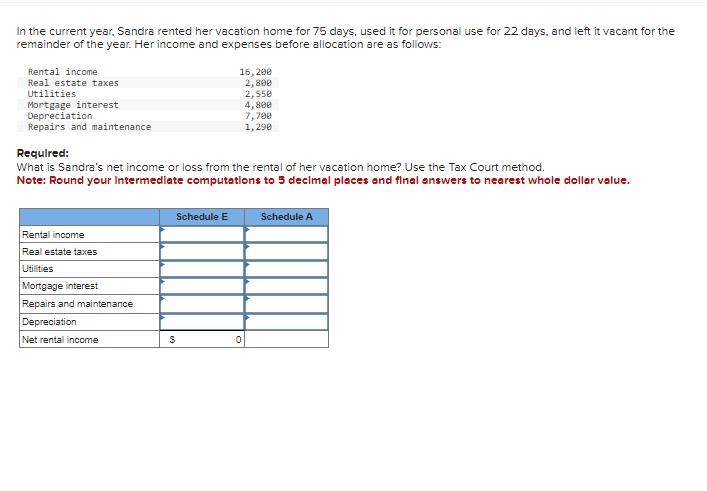

Solved In the current year Sandra rented her vacation home Chegg com

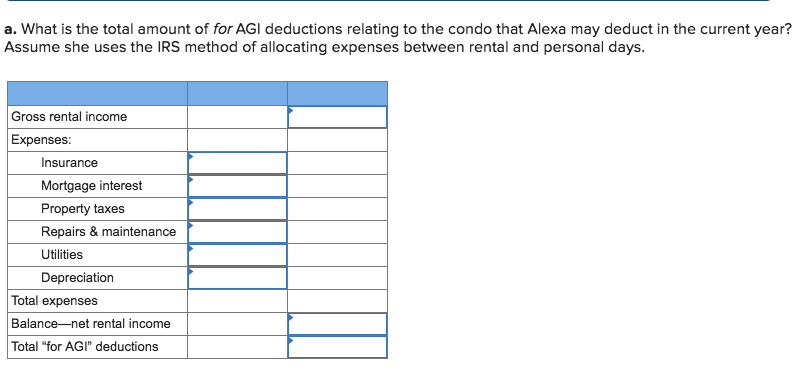

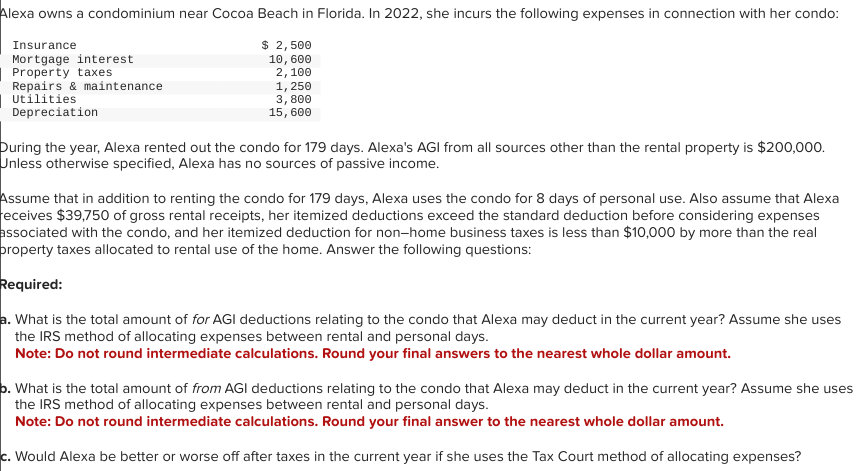

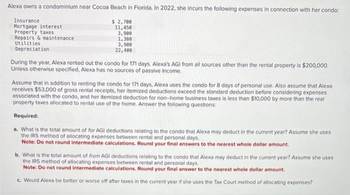

Solved : Alexa owns a condominium near Cocoa Beach in Flor

Solved Choose the response that correctly describes why a Chegg com

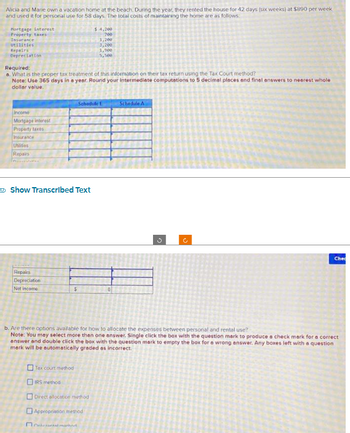

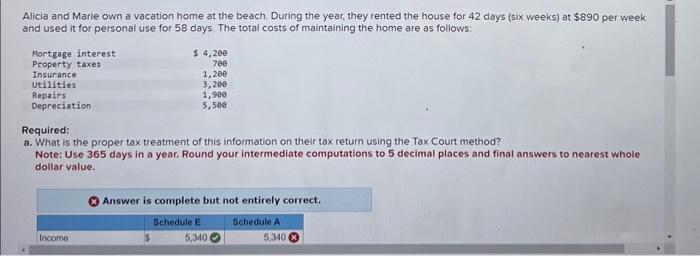

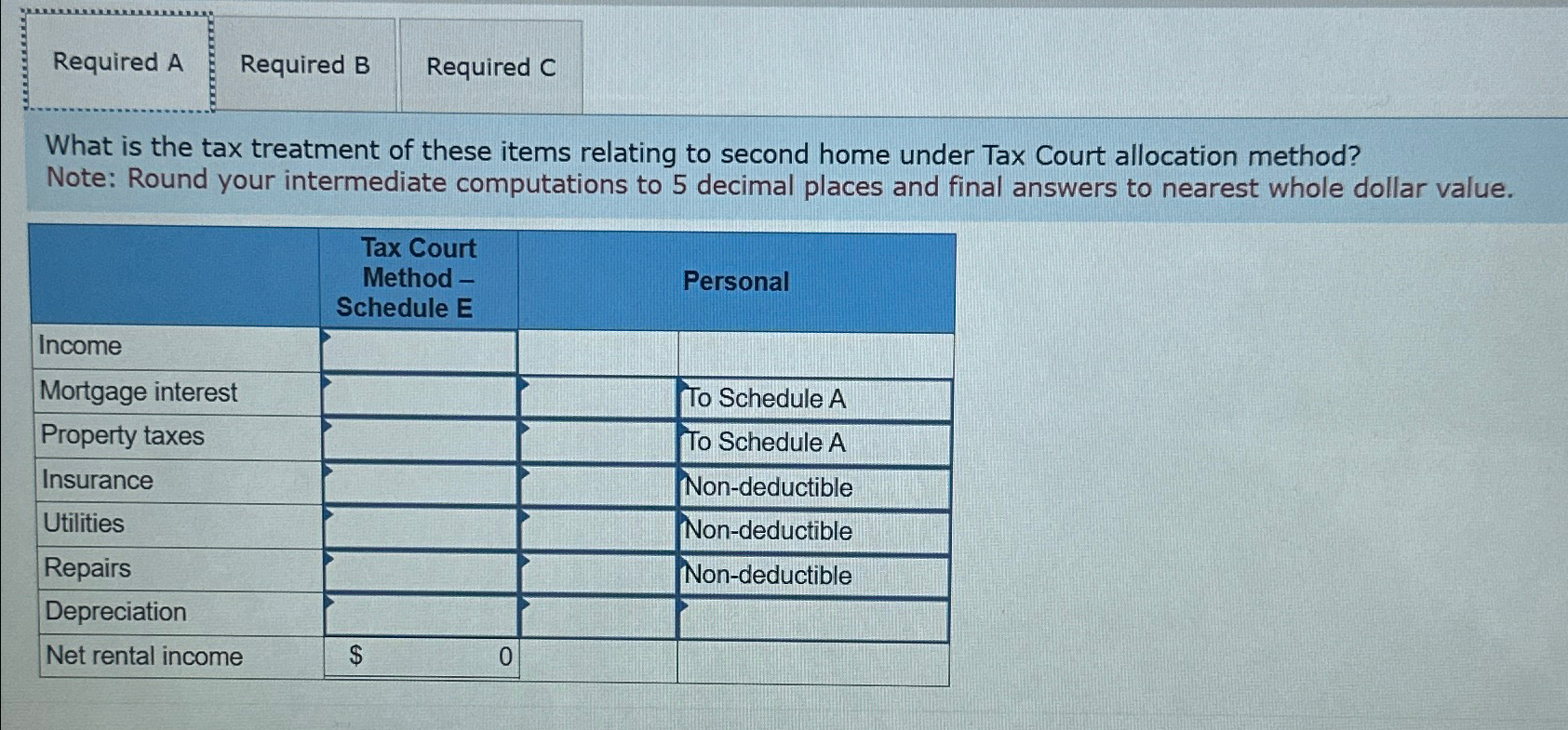

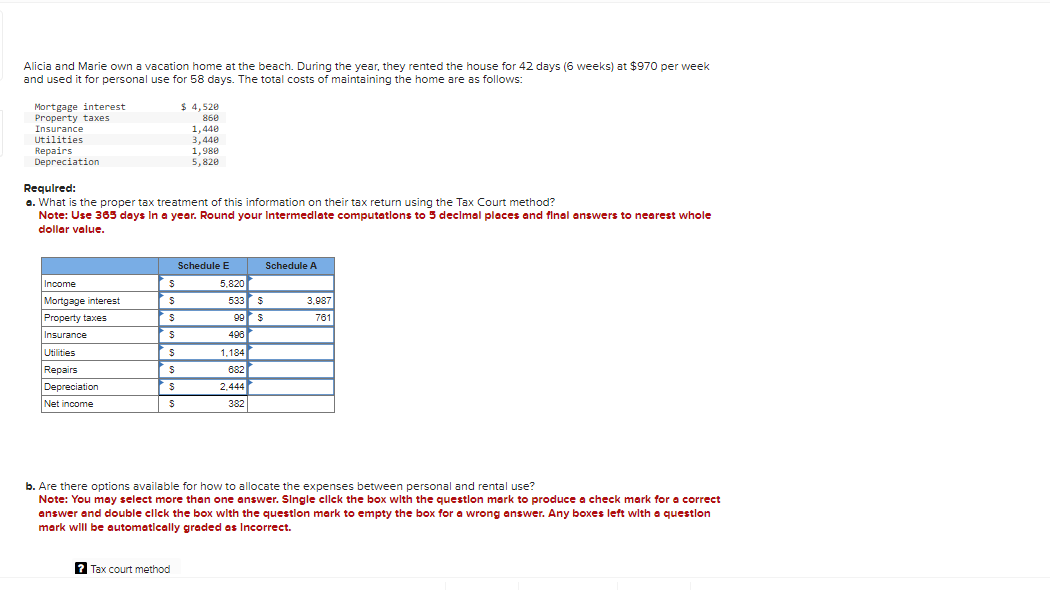

Solved Alicia and Marie own a vacation home at the beach Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

Answered: Alicia and Marie own a vacation home at bartleby

Solved The following information applies to the questions Chegg com

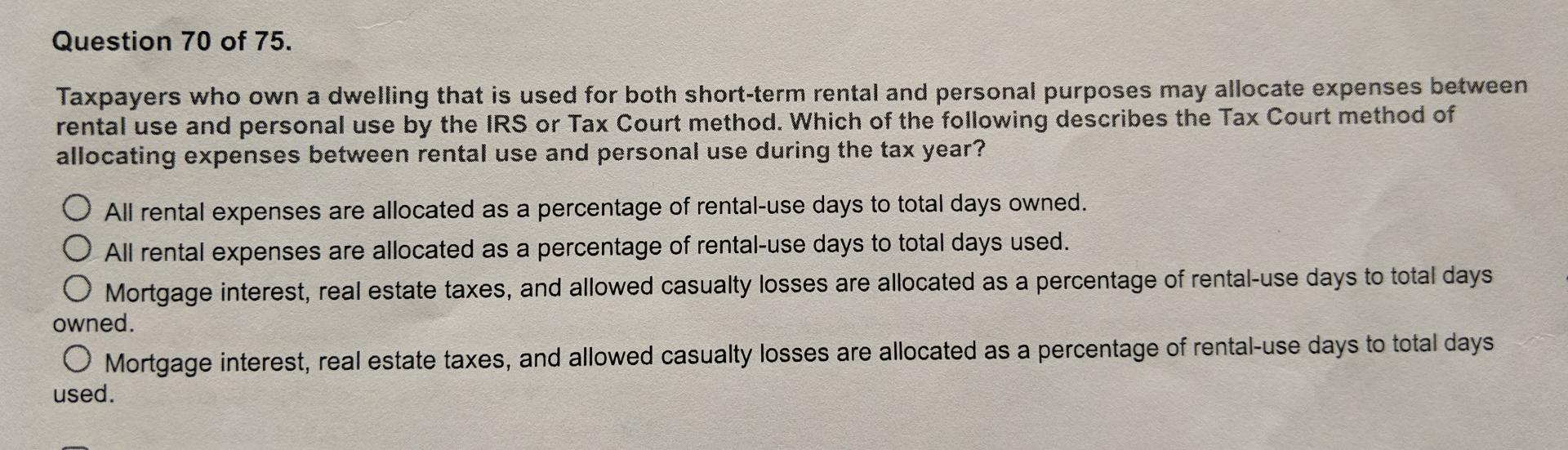

Solved Question 70 of 75 Taxpayers who own a dwelling that Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

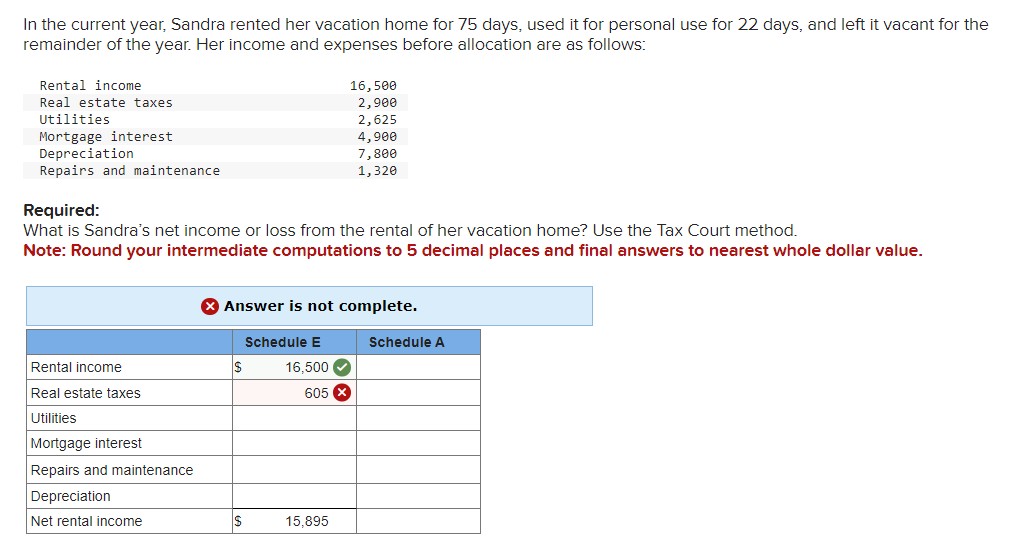

Solved In the current year Sandra rented her vacation home Chegg com

Solved Randolph and Tammy own a second home They spent 45 Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Answered: Required: a What is the total amount of for AGI deductions

Solved Alicia and Marie own a vacation home at the beach Chegg com

Answered: Alexa owns a condominium near Cocoa bartleby

Answered: Required: a What is the total amount of for AGI (rental

Solved Randolph and Tammy own a second home They spent 45 Chegg com