Section 163 J Computation Worksheet

Here are some of the images for Section 163 J Computation Worksheet that we found in our website database.

Sec 163(j) planning considerations PDF Expense Lease

Tax Computation Worksheet Printable PDF Template

Fillable 2023 Tax Computation Worksheet (Form 1040) PDFliner

Tax Computation Worksheet 2024 Printable For Parents

Fillable Form 1040 Individual Income Tax Return 2023 2024

Calculate Income Tax in Excel AY 2024 25 Template Examples

Final Regulations Under IRC Section 163(J)

How Section 163(j) Helps Small Businesses Tsamutalis Company

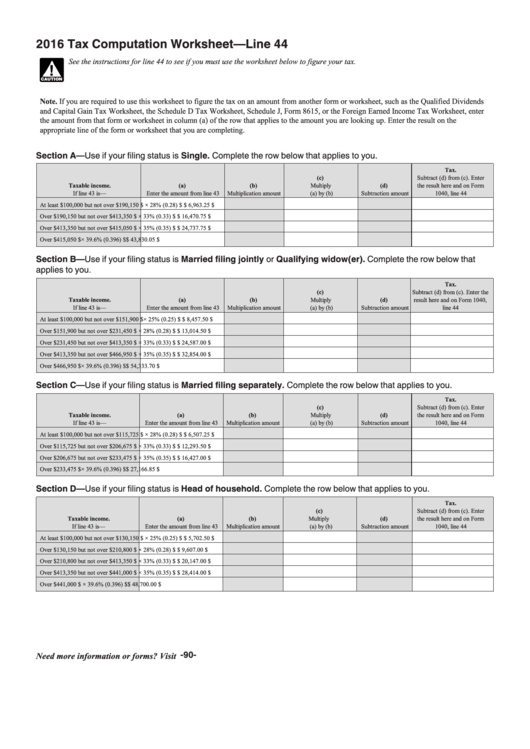

Tax Computation Worksheet Line 44 2016 printable pdf download

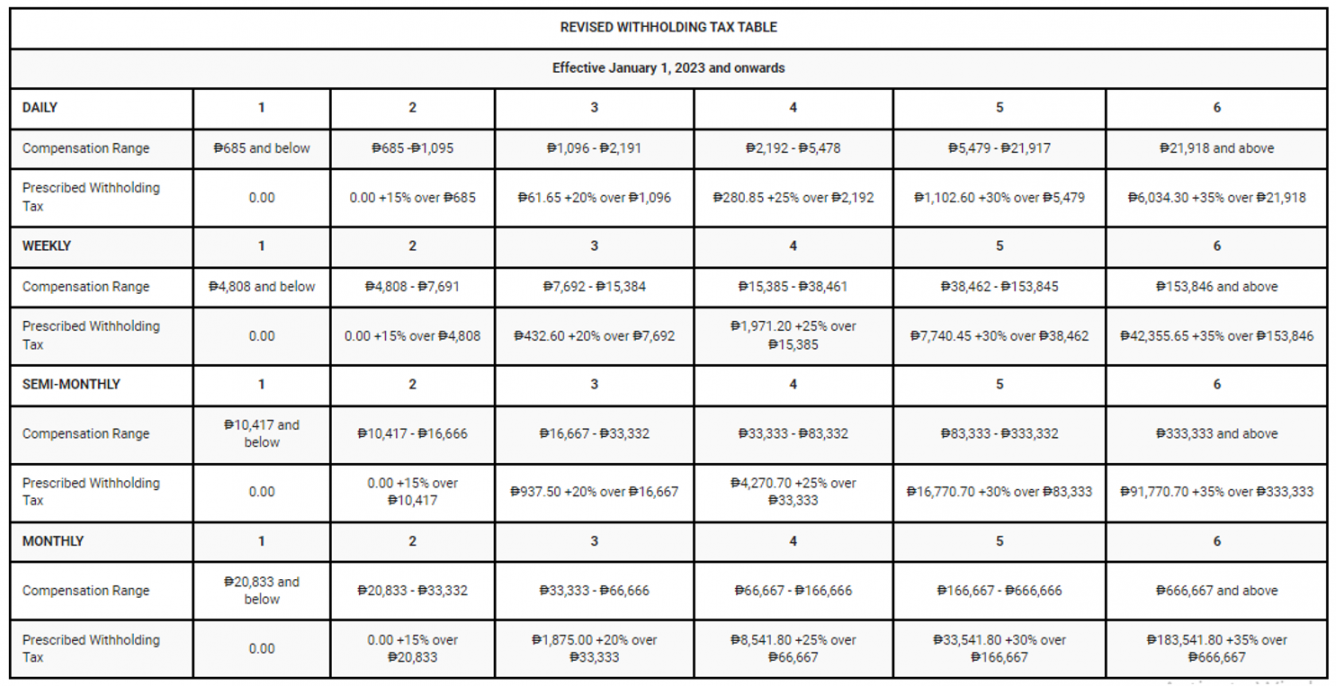

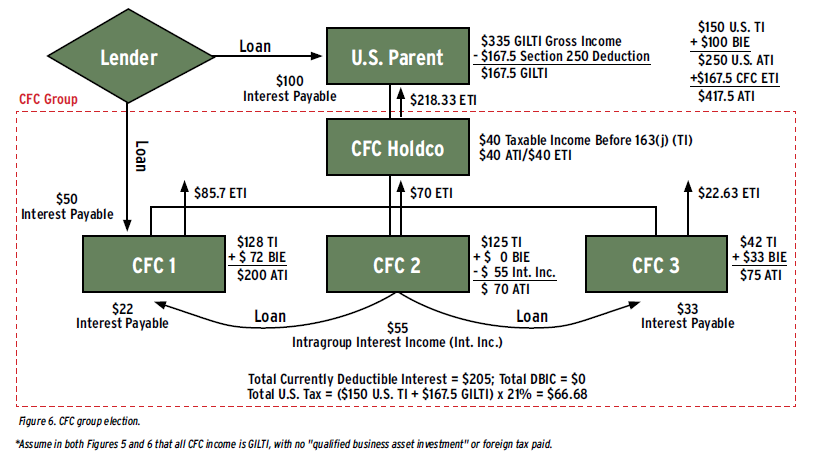

2023 Rhode Island Ri 1041 Tax Computation Worksheet Draft Fill Out

Small Business Interest Expense Deduction Section 163(j)

α j computation process Download Scientific Diagram

α j computation process Download Scientific Diagram

Scratching the Surface Impact of Section 163(j) on Real Estate Withum

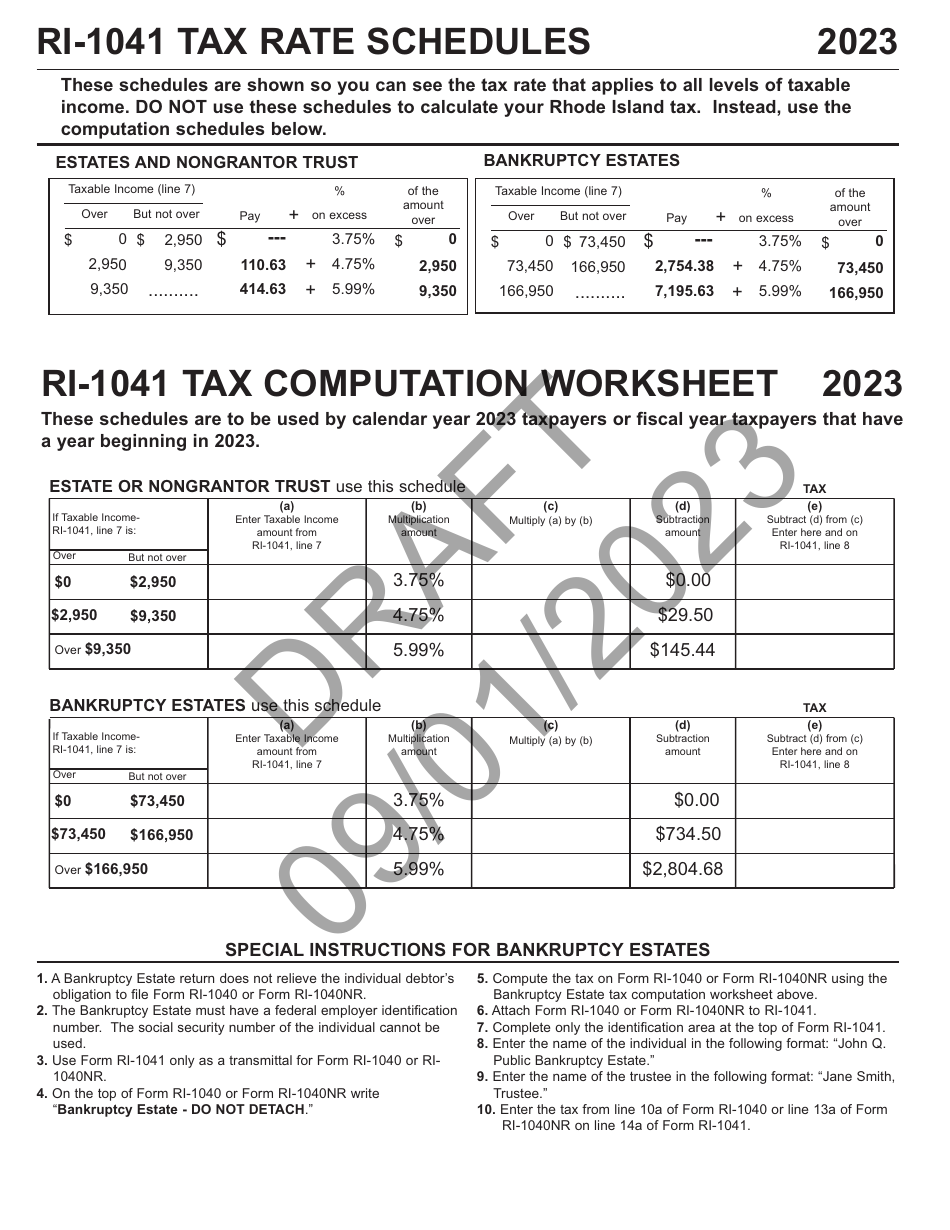

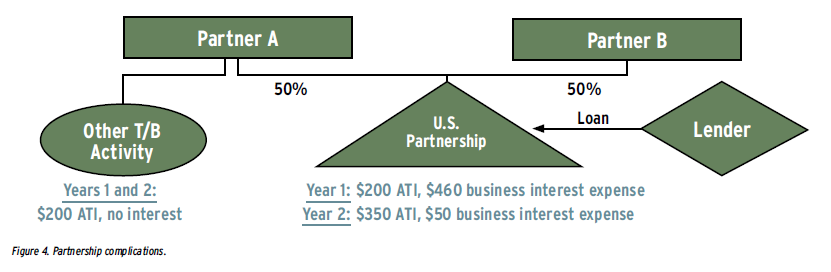

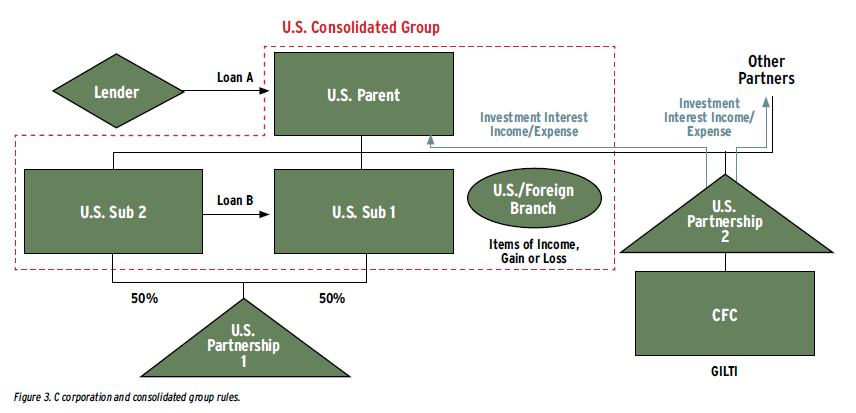

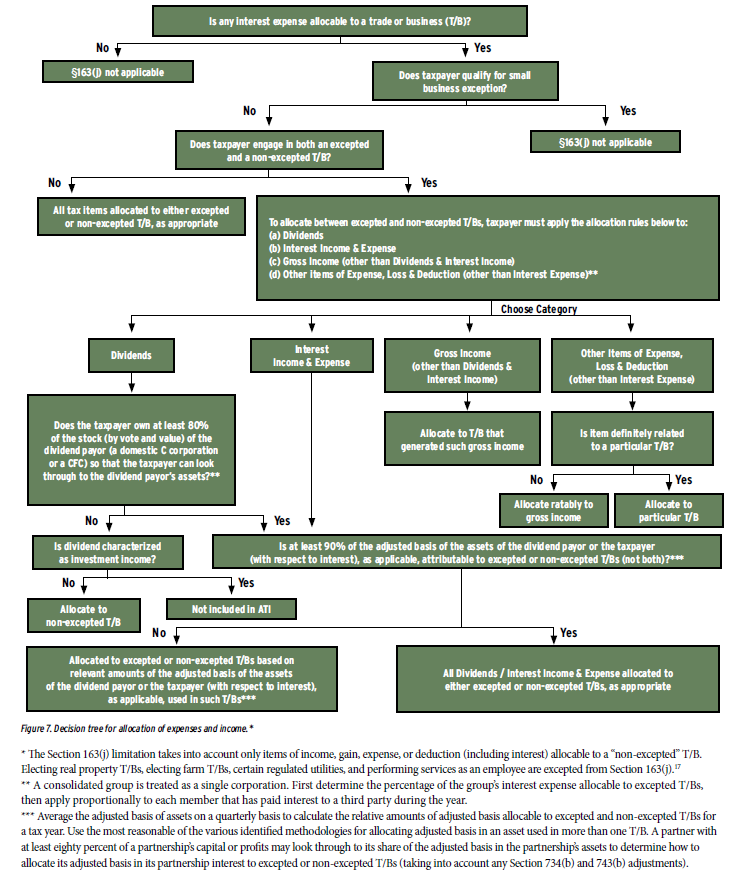

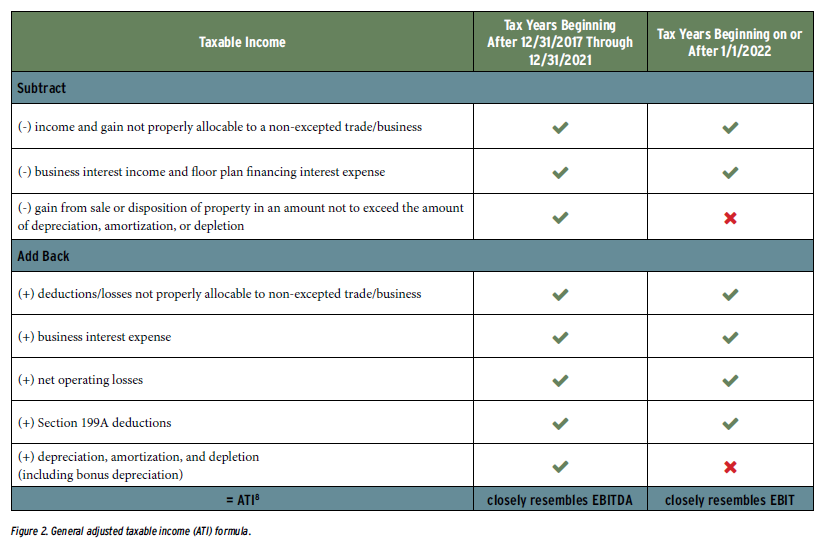

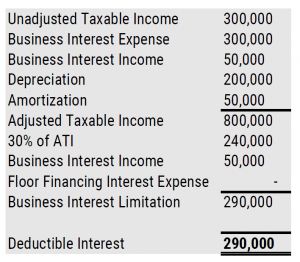

Part I: The Graphic Guide to Section 163(j) Tax Executive

Part I: The Graphic Guide to Section 163(j) Tax Executive

Part I: The Graphic Guide to Section 163(j) Tax Executive

Part I: The Graphic Guide to Section 163(j) Tax Executive

Part I: The Graphic Guide to Section 163(j) Tax Executive

Part I: The Graphic Guide to Section 163(j) Tax Executive

Interest Expense Limitation Under Section 163(j) for Businesses SC H

IRC Section 163(j): What You Need to Know and Do FustCharles

Comment letter: proposed regulations under IRC section 163(j) Baker Tilly

Unraveling the Complexities of the Revised Section 163(j): A

How IRC Section 163(j) Affects Investors: What You Need to Know

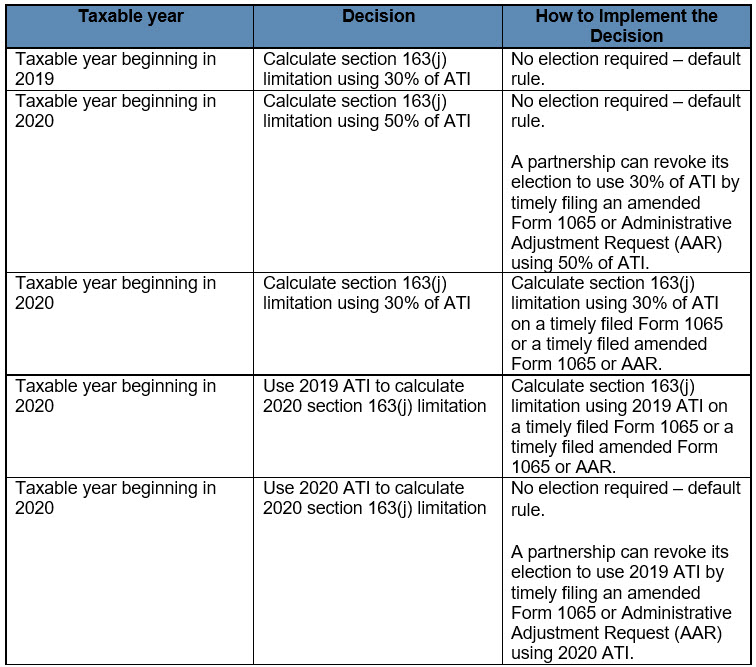

Changes to the Section 163(j) Business Interest Limitation Under the

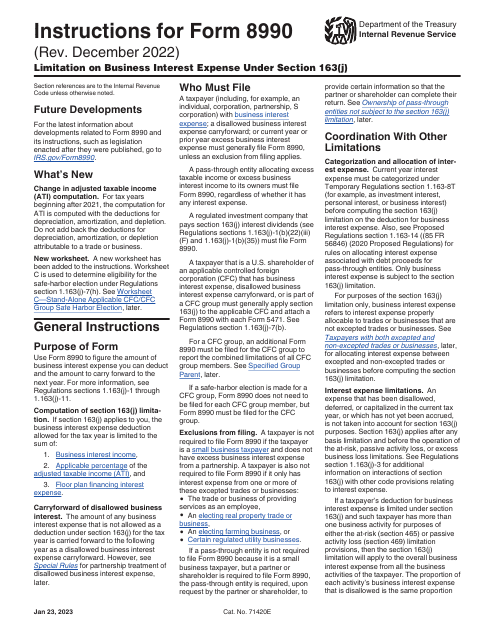

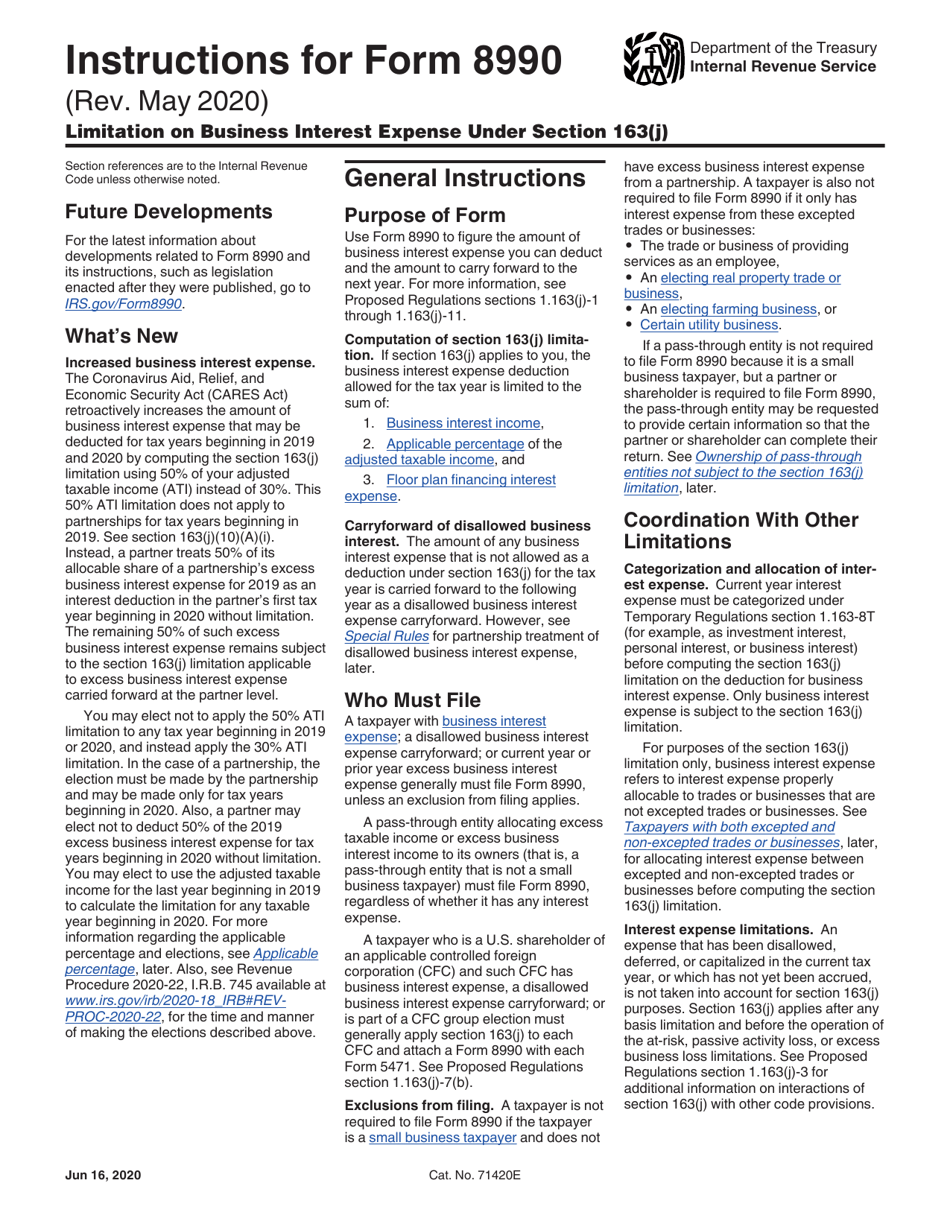

Download Instructions for IRS Form 8990 Limitation on Business Interest

Business interest limitation rules (section 163(j)) Where do we stand

Download Instructions for IRS Form 8990 Limitation on Business Interest

Discussing the international implications of Section 163(j) Our

What are the new rules for business interest expense deduction under

More Interest Less Limitation: Section 163(j) Gets a Boost in 2025

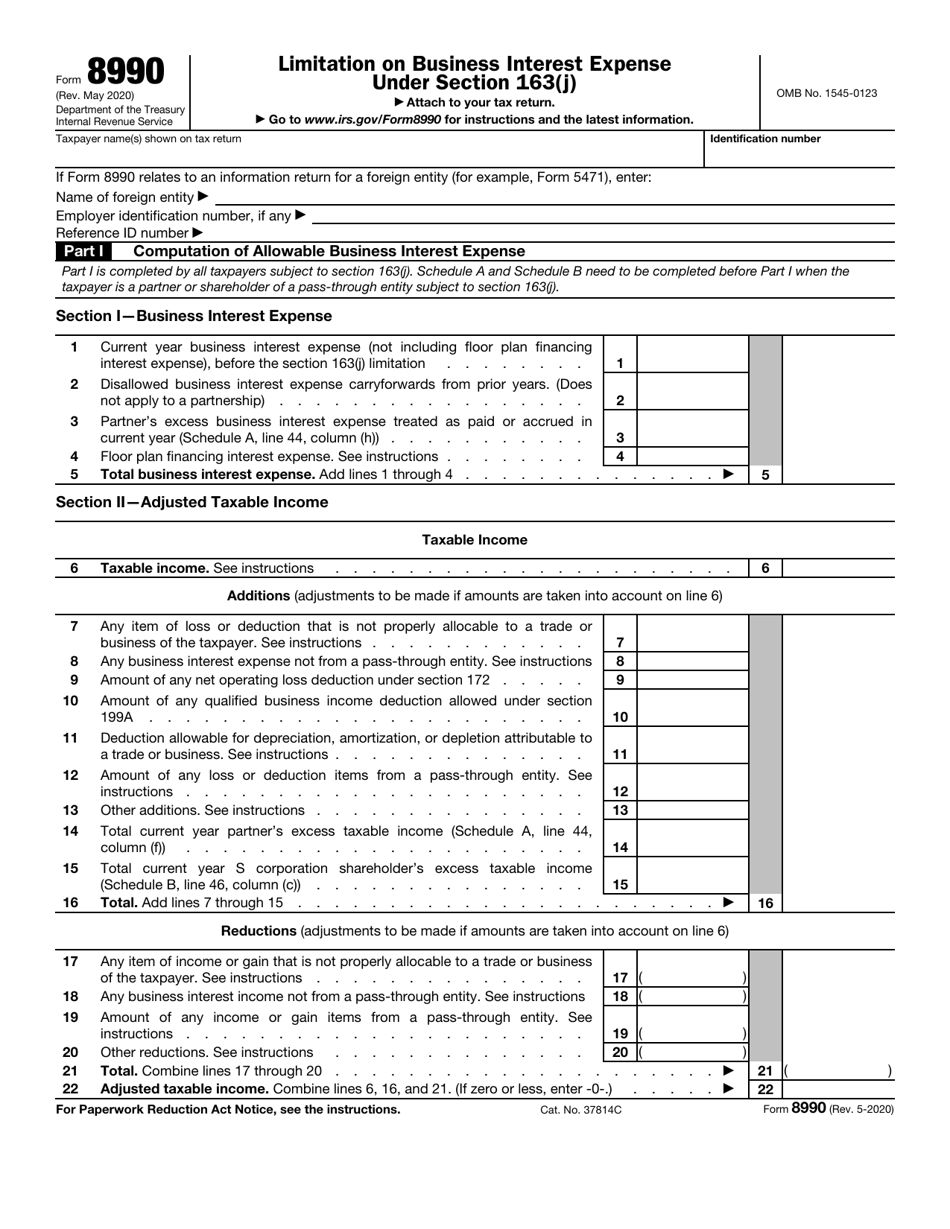

IRS Form 8990 Download Fillable PDF or Fill Online Limitation on

A Matter of Interest: To Elect or Not to Elect the CARES Act

IRS Issues Proposed Regulations on Section 163(j) Interest / irs

Florida Amends IRC Conformity Date Decouples from Gilti and Conforms

United States: Section 163(j) Regulations Are Finally Final

The Real Estate Trade or Business Exception from IRC Section 163(j

What Is A Federal Carryover Worksheet Printable Word Searches

Download Instructions for IRS Form 8990 Limitation on Business Interest

Inst 8926 Instructions for Form 8926 Disqualified Corporate Interest

Inst 8926 Instructions for Form 8926 Disqualified Corporate Interest

The Section 179 Deduction and Bonus Depreciation: Understand the

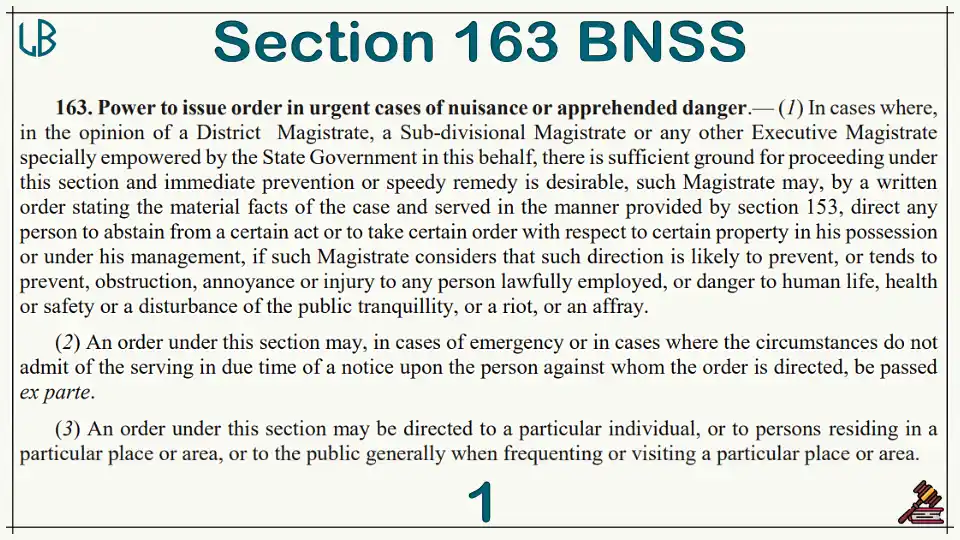

Section 163 BNSS: उपद्रव या आशंकित खतरों के अर्जेंट मामलों में आदेश

Schedule P: Previously Taxed E P of US Shareholder IRS Form 5471

IRS Form 8990 Schedule A walkthrough (Partnerships subject to Section

Ticket Information Churchill Downs

Graduation Invitation Printable prntbl concejomunicipaldechinu gov co

Accounting for Grant Restrictions and Grant Conditions Clark Schaefer

Pirate Ship Outside Court prntbl concejomunicipaldechinu gov co

What Is Floor Plan Financing Interest Expense Viewfloor co

Pirate Ship Outside Court prntbl concejomunicipaldechinu gov co

Pirate Ship Outside Court prntbl concejomunicipaldechinu gov co

Pirate Ship Outside Court prntbl concejomunicipaldechinu gov co

Pirate Ship Outside Court prntbl concejomunicipaldechinu gov co

Webinars Integra International

Thread by GlenBirnbaum: quot interest limitations are quite complex

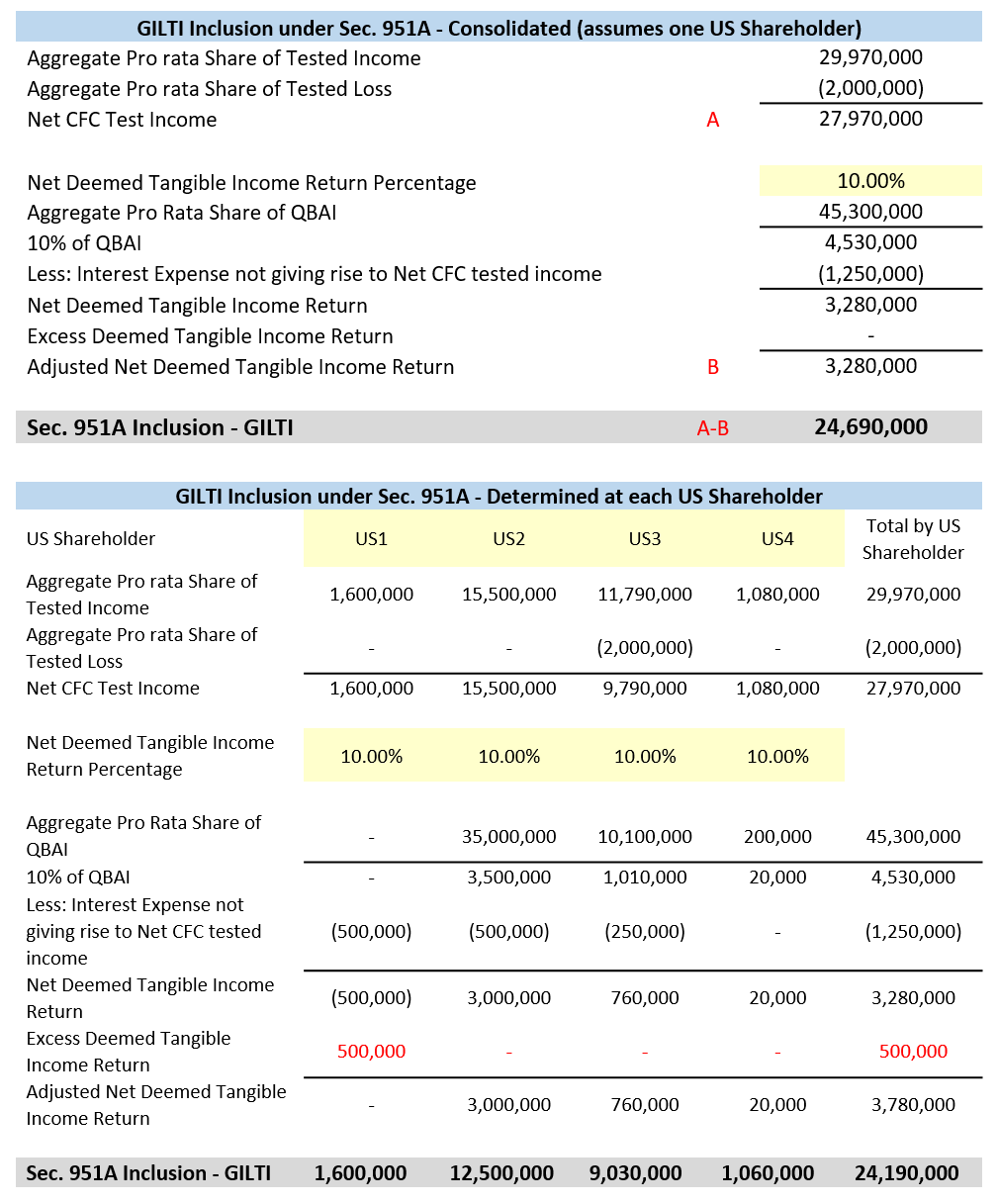

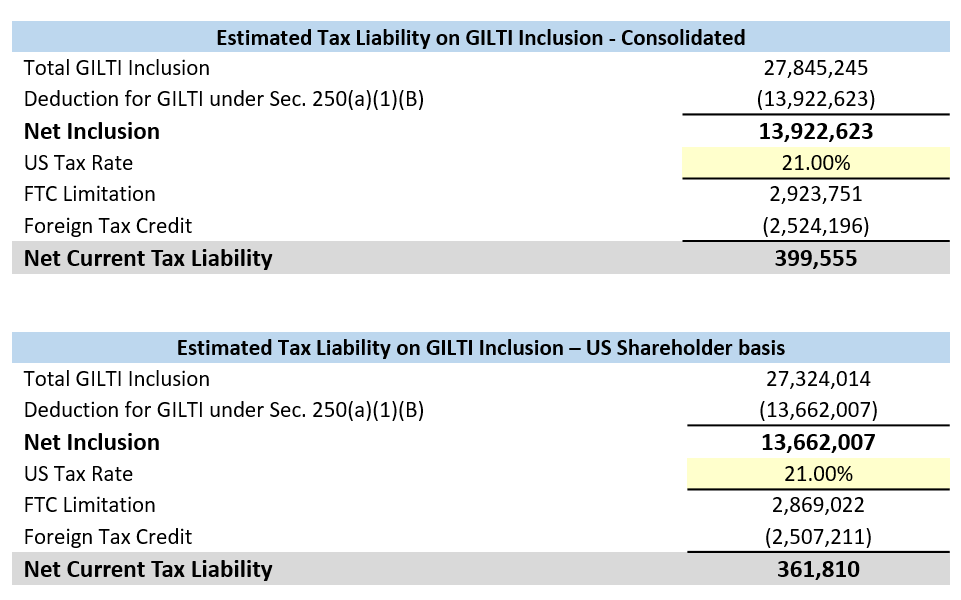

GILTI Calculation Demystified: Consolidated vs Entity Calculations

GILTI Calculation Demystified: Consolidated vs Entity Calculations

GILTI Calculation Demystified: Consolidated vs Entity Calculations