Tax Court Method For Vacation Home

Here are some of the images for Tax Court Method For Vacation Home that we found in our website database.

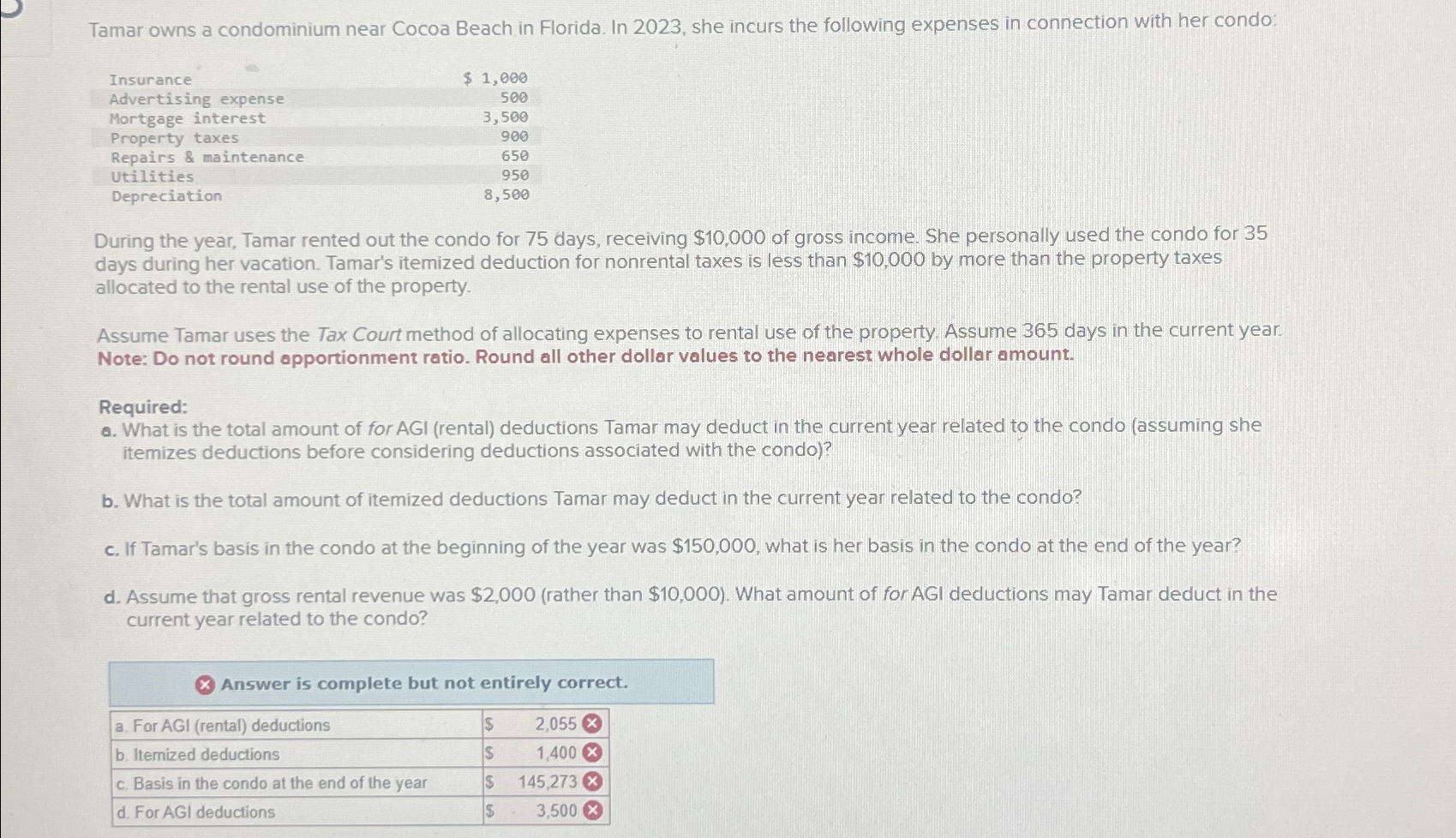

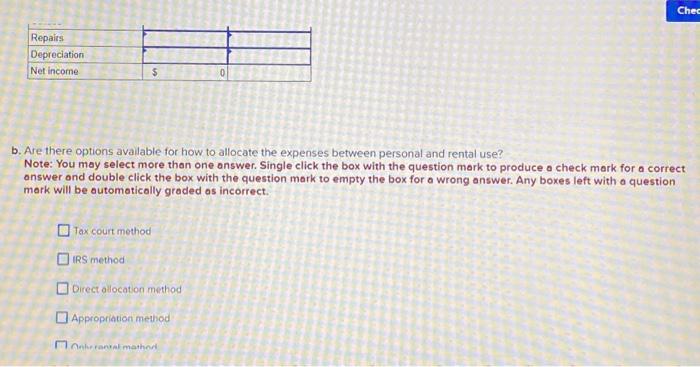

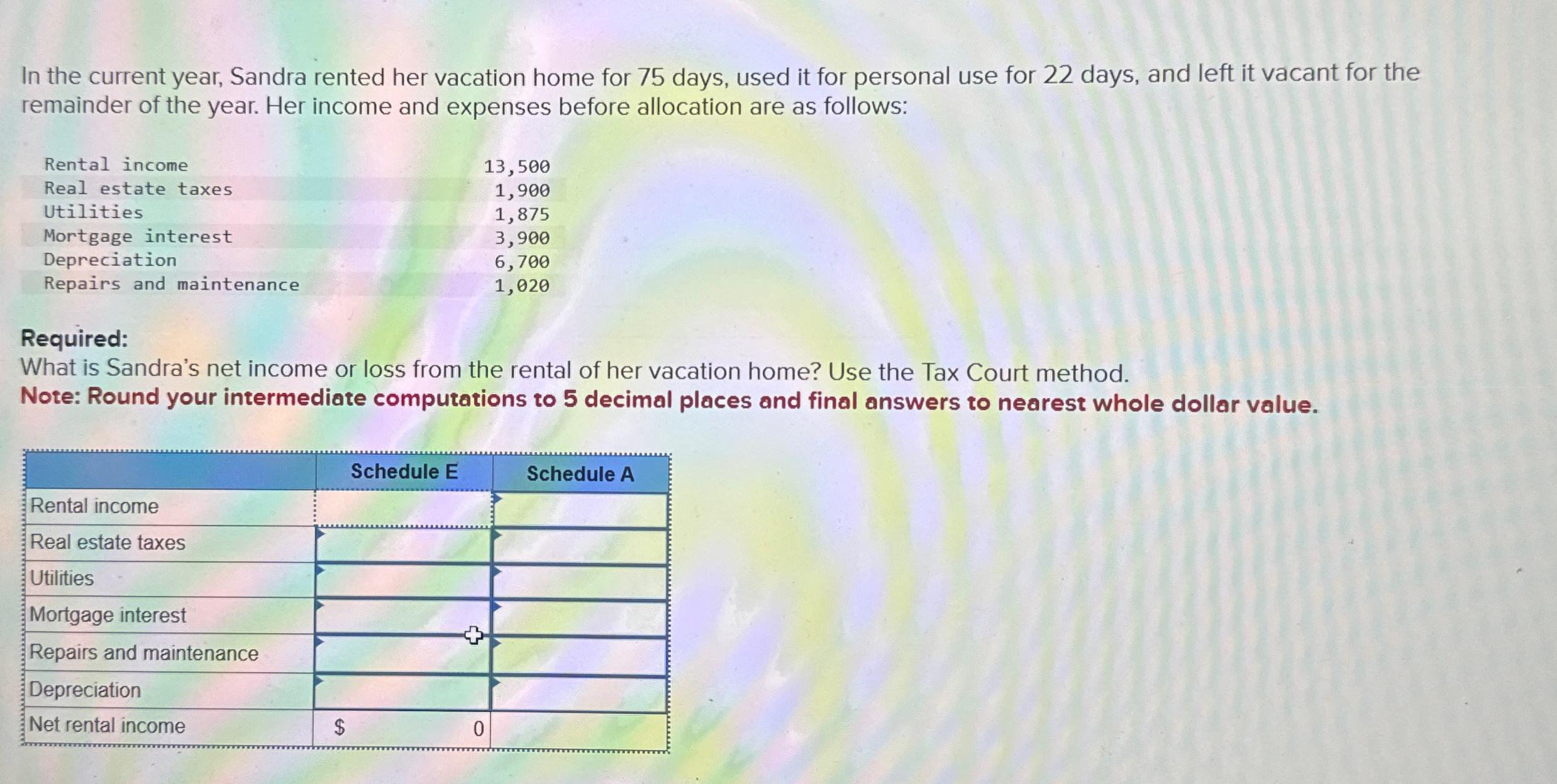

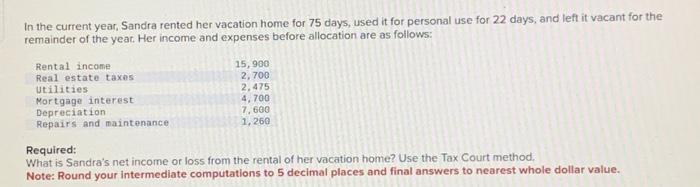

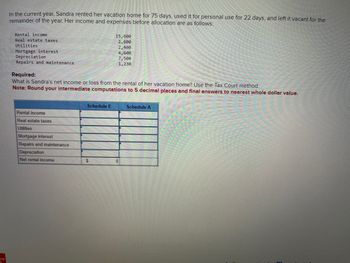

Please use TAX COURT METHOD not Irs method Chegg com

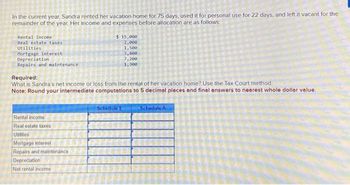

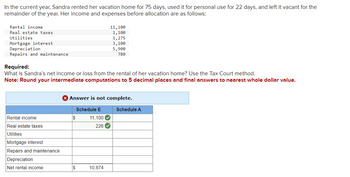

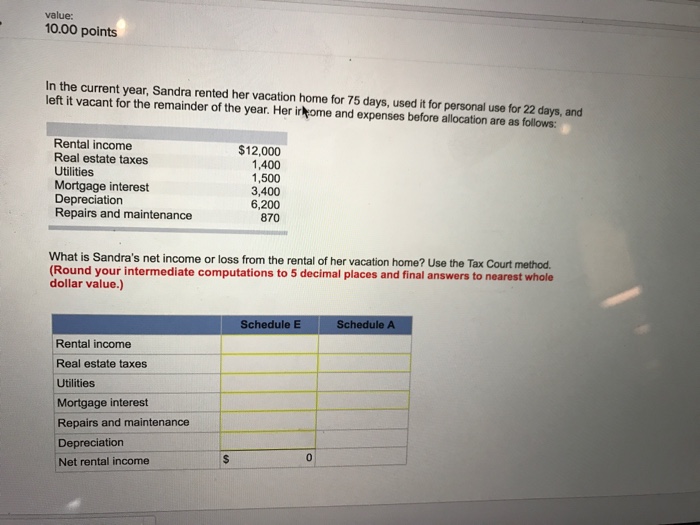

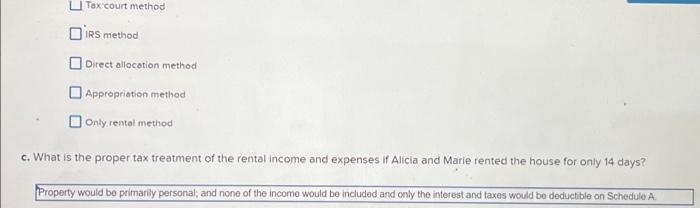

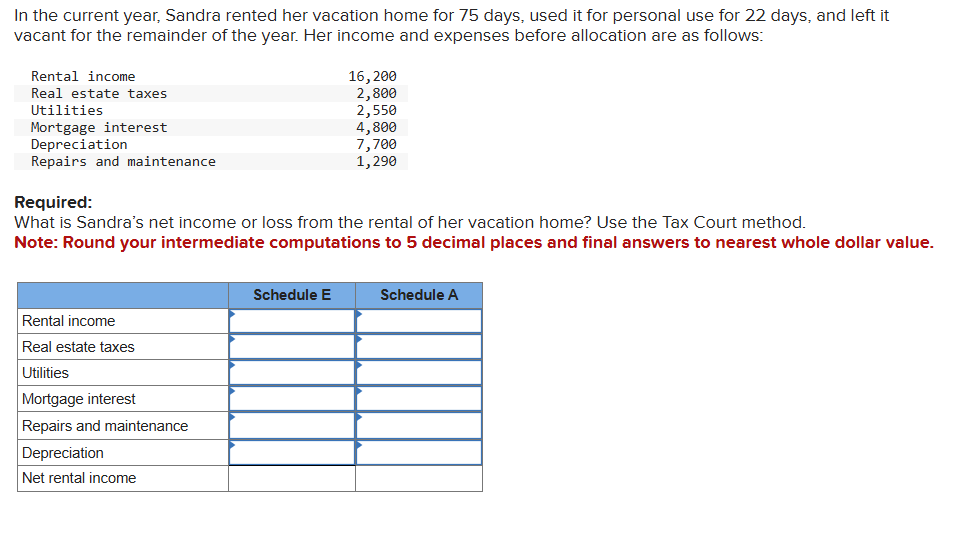

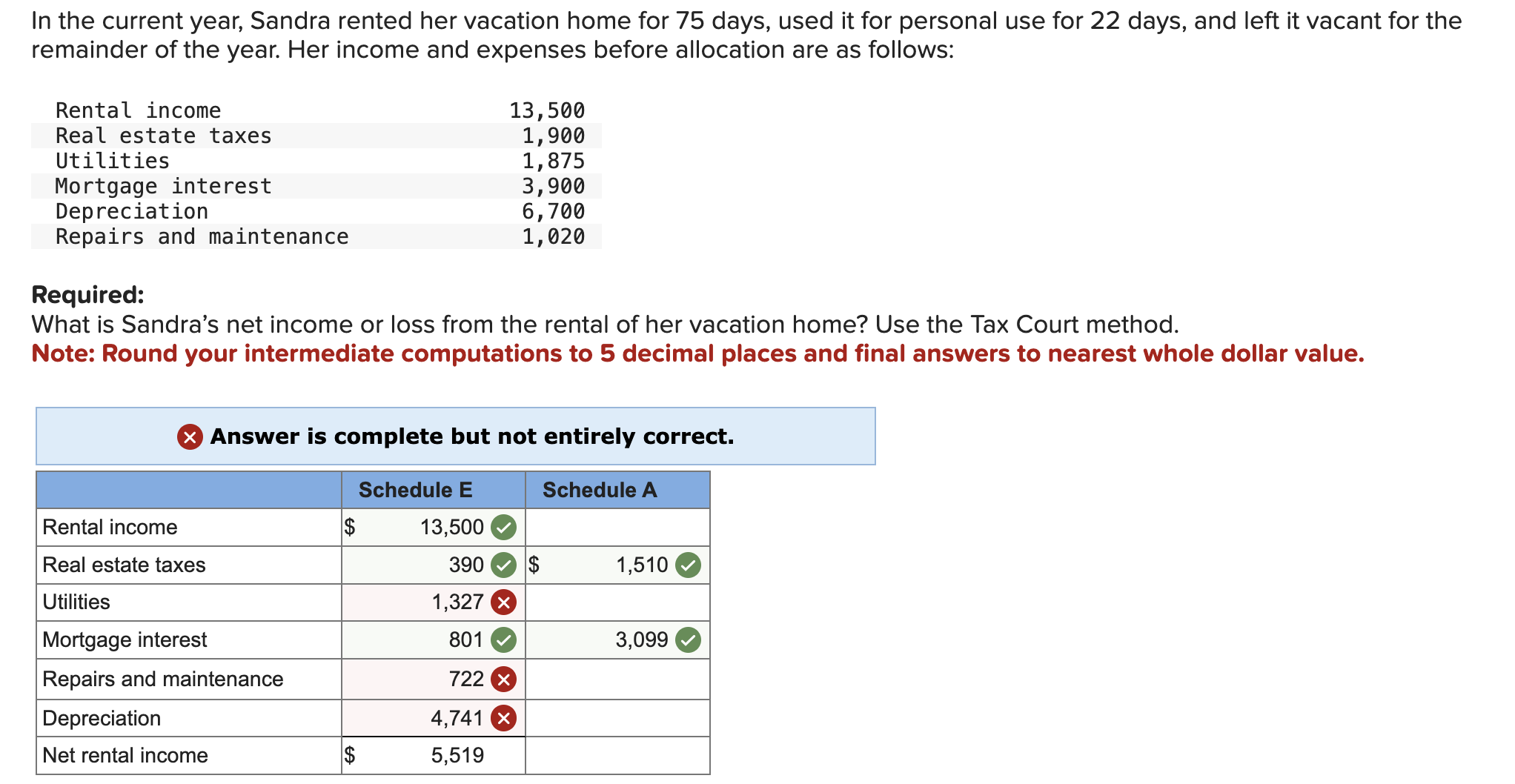

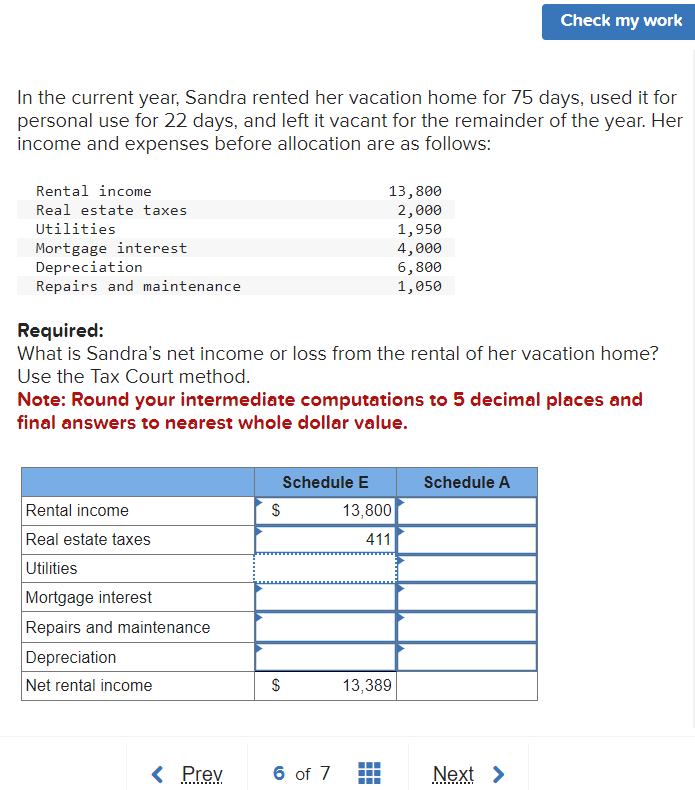

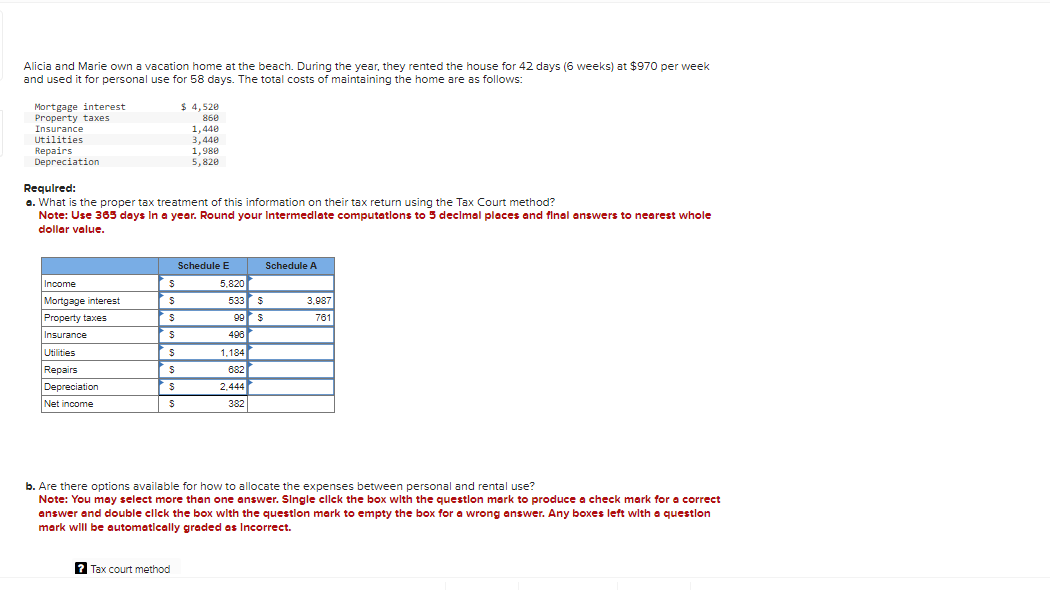

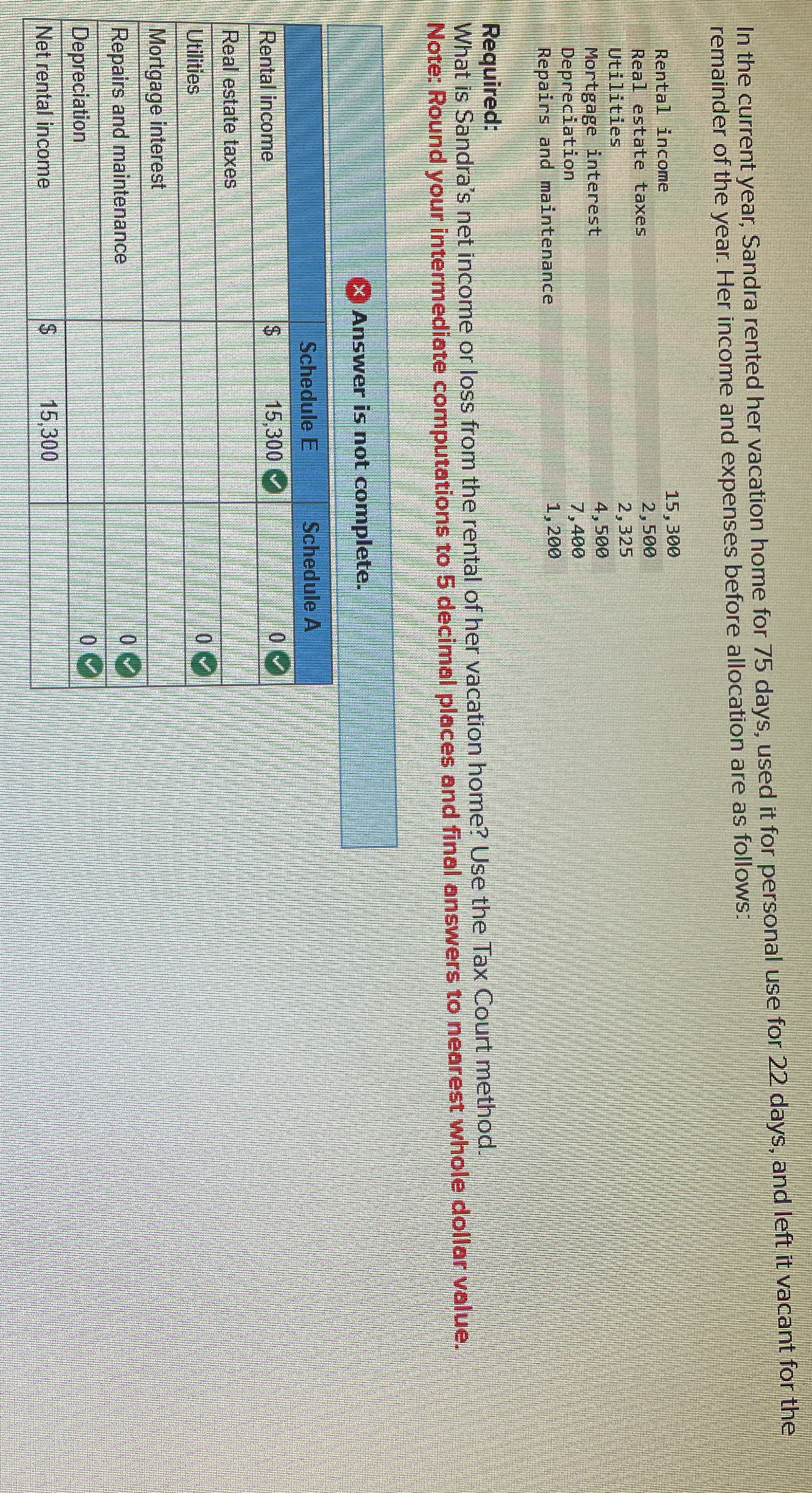

Answered: What is Sandra #39 s net income or loss from the rental of her

Answered: Required: What is Sandra #39 s net income or loss from the rental

David A Hutchison E A on LinkedIn: 5 Tax Tips for Renting Out Your

Vacation Home Tax Rules Bolton Method WCG CPAs Advisors

Vacation Home Tax Rules Bolton Method WCG CPAs Advisors

Vacation Home Tax Rules Bolton Method WCG CPAs Advisors

Solved In the current year Sandra rented her vacation home Chegg com

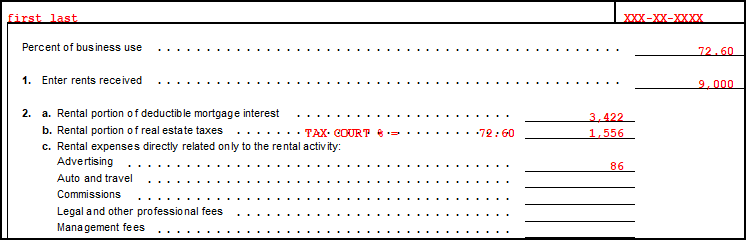

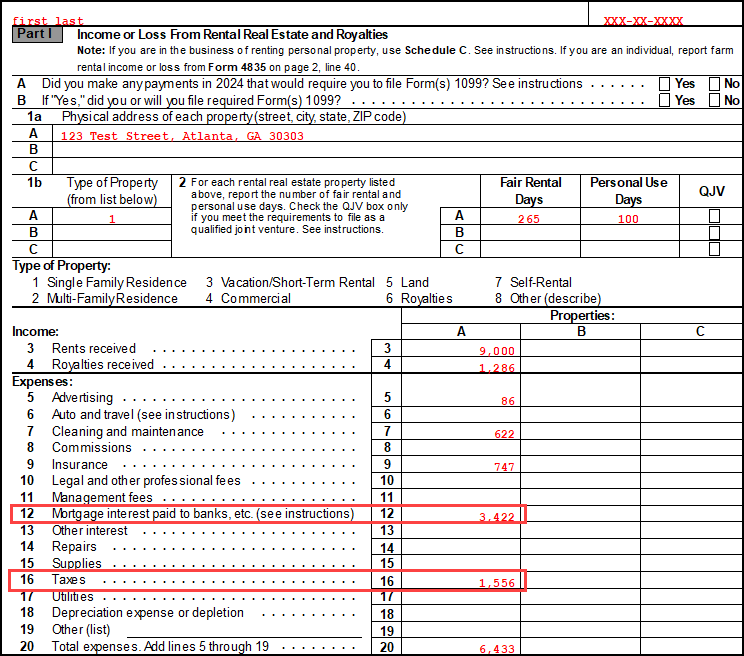

Drake Tax 1040 Schedule E Tax Court Method Election

Drake Tax 1040 Schedule E Tax Court Method Election

Real Estate Investment Rental Property Tax Matters WCG CPAs Advisors

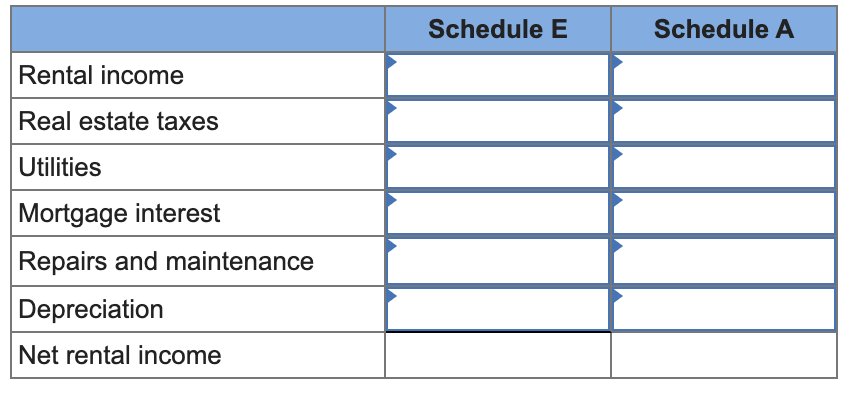

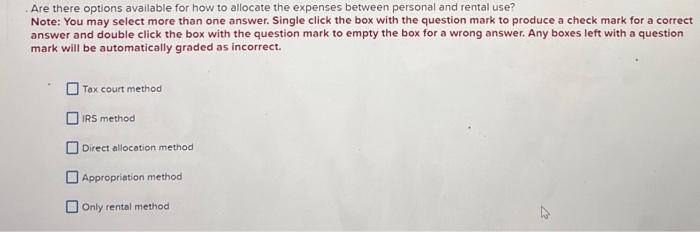

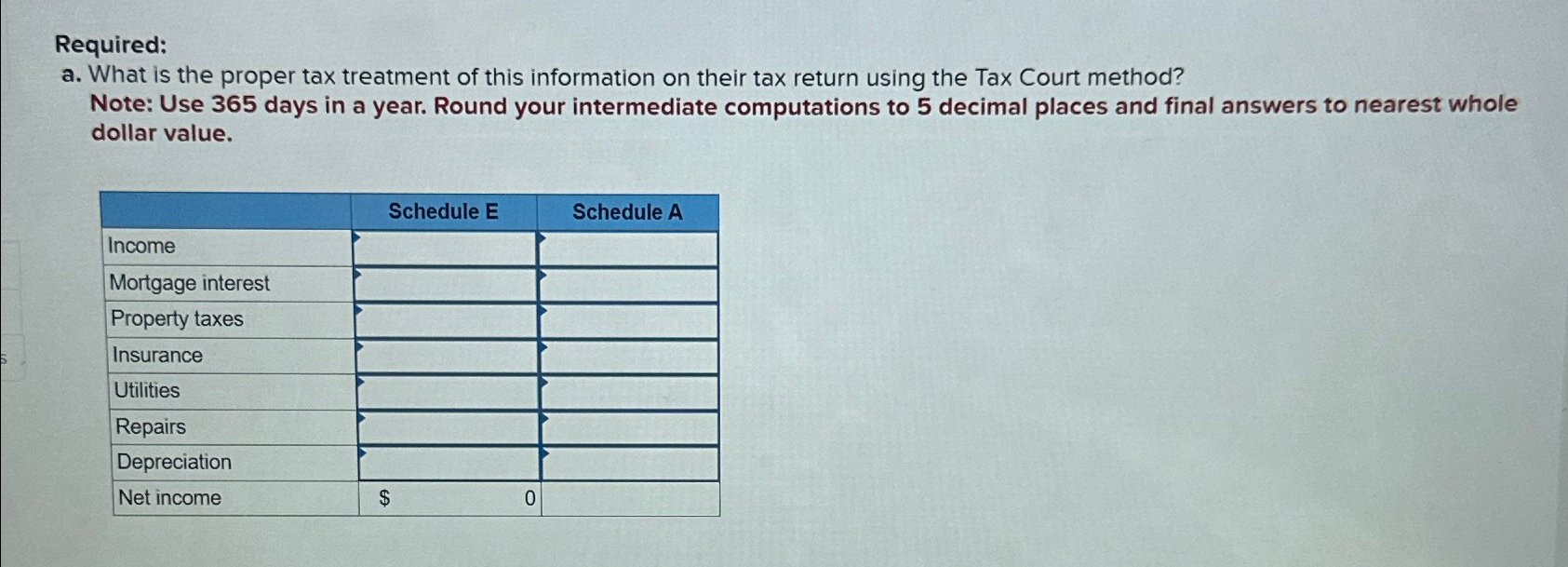

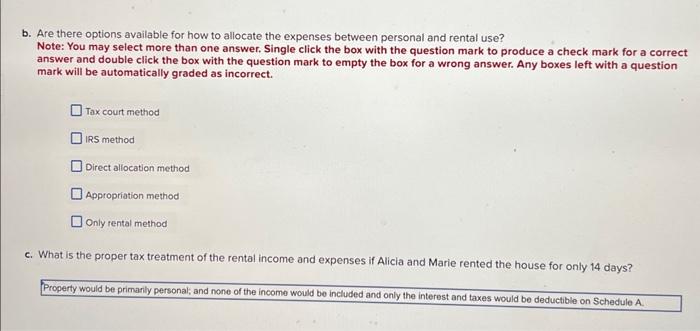

Answered: Required: a What is the proper tax treatment of this

Solved In the current year Sandra rented her vacation home Chegg com

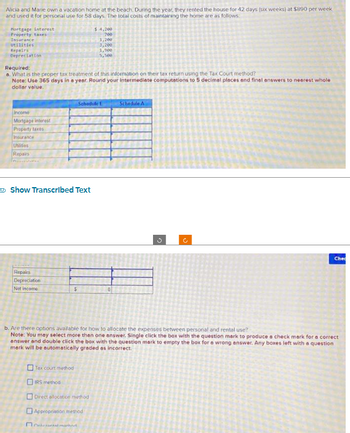

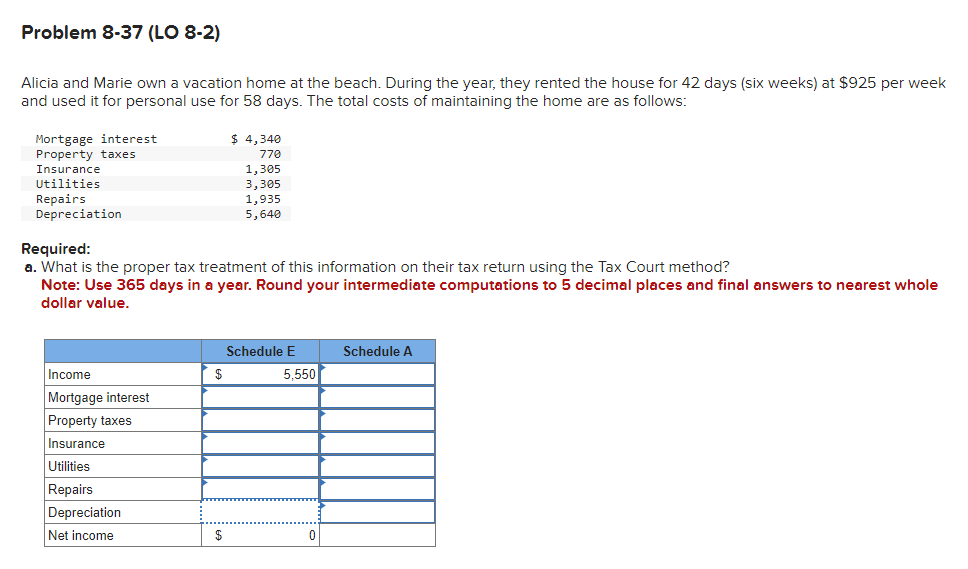

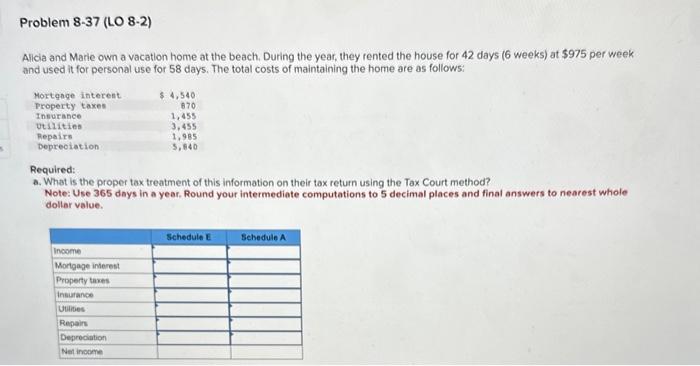

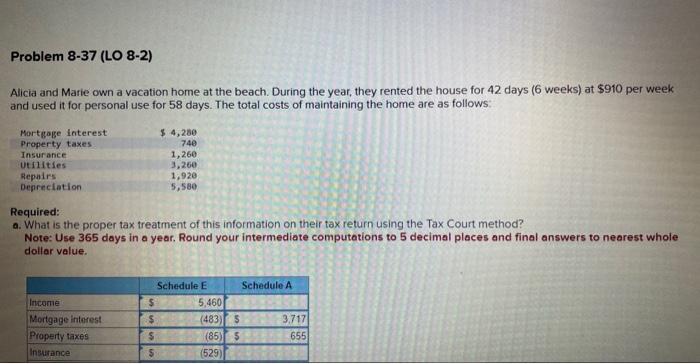

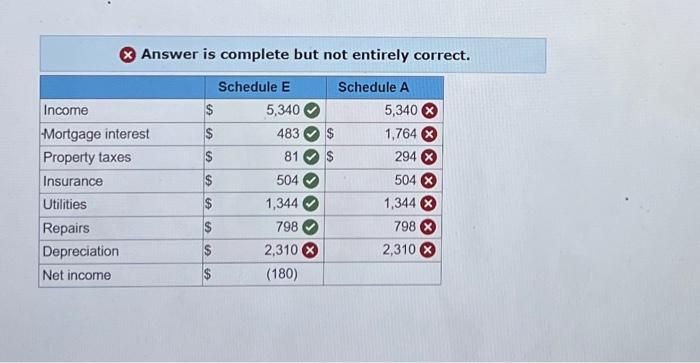

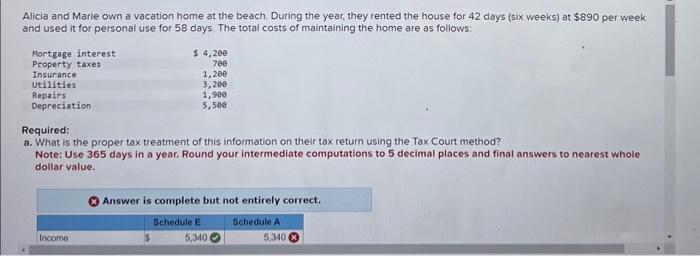

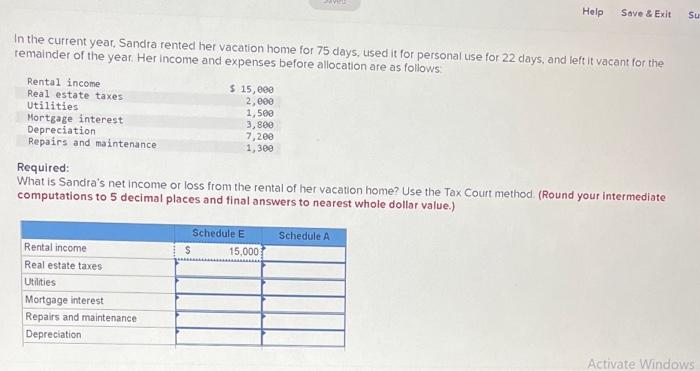

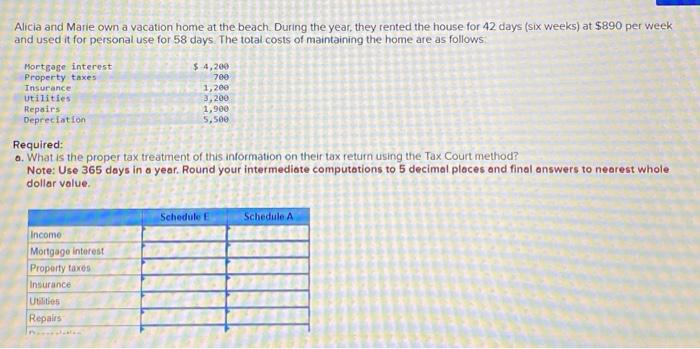

Solved Alicia and Marie own a vacation home at the beach Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

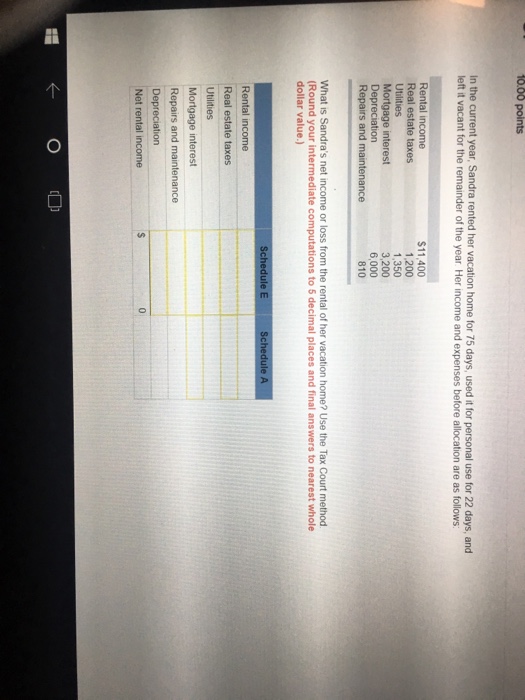

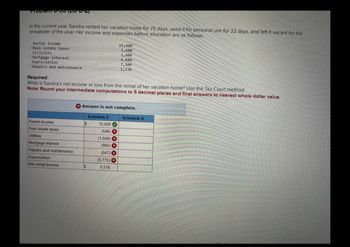

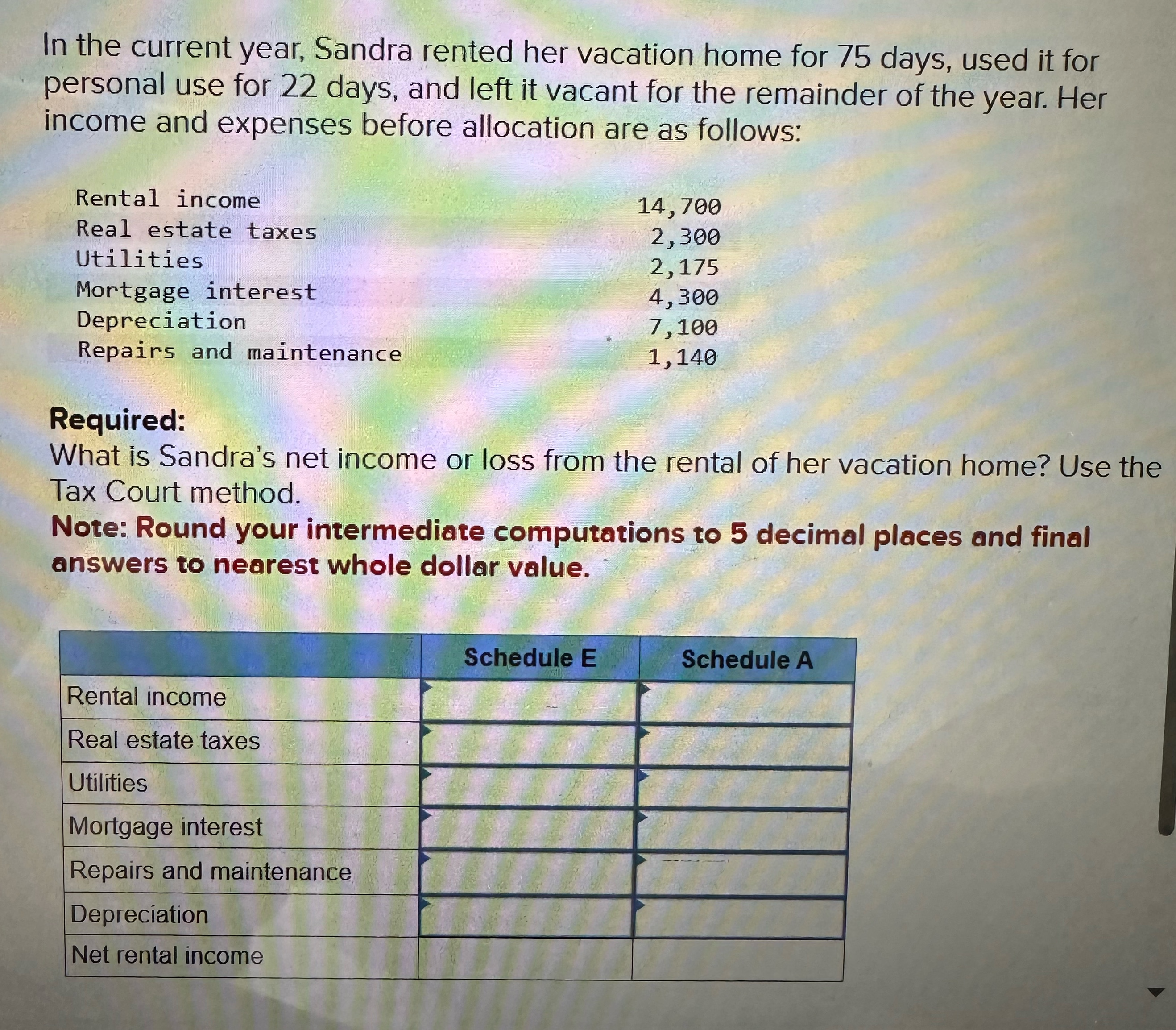

Solved In the current year Sandra rented her vacation home for 75

Solved Alicia and Marie own a vacation home at the beach Chegg com

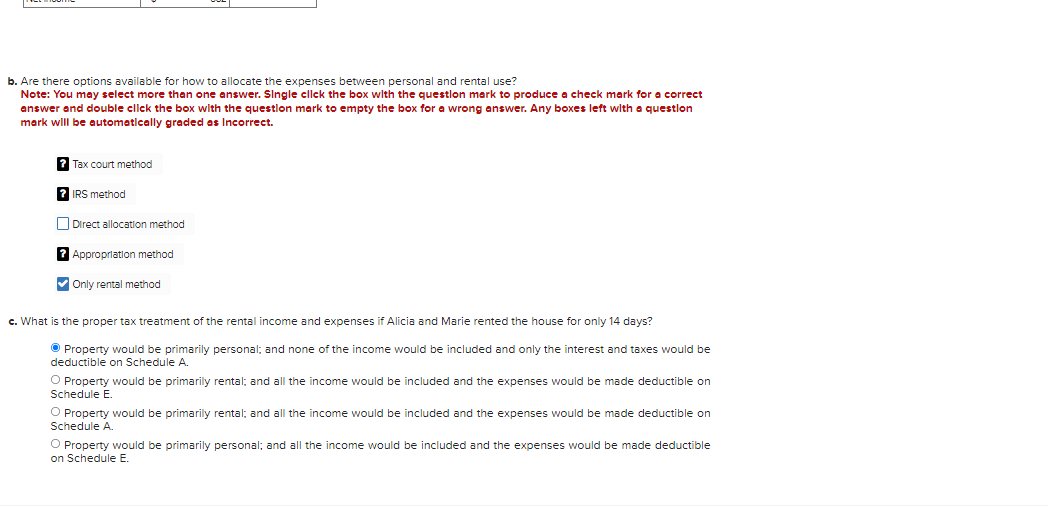

Answered: Alicia and Marie own a vacation home at bartleby

Answered: Required: a What is the proper tax bartleby

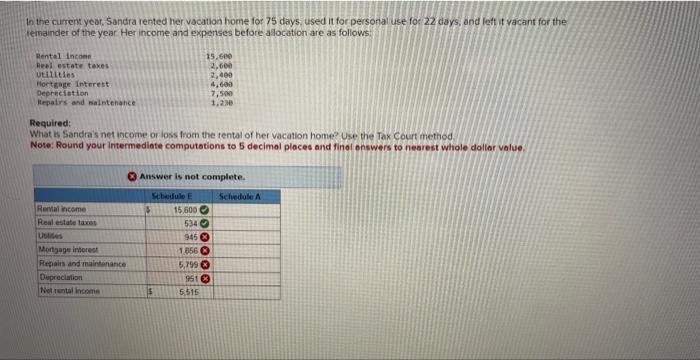

Solved In the current year Sandra rented her vacation home Chegg com

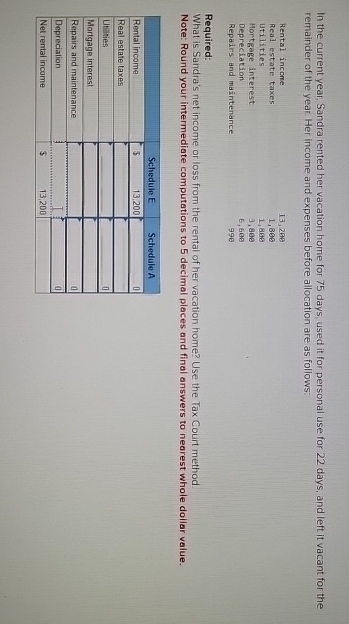

Answered: me current year Sandra rented her bartleby

Solved Alicia and Marie own a vacation home at the beach Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

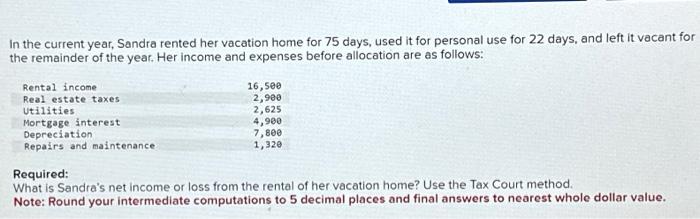

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved Alicia and Marie own a vacation home at the beach Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Alicia and Marie own a vacation home at the beach Chegg com

Alicia and Marie own a vacation home at the beach Chegg com

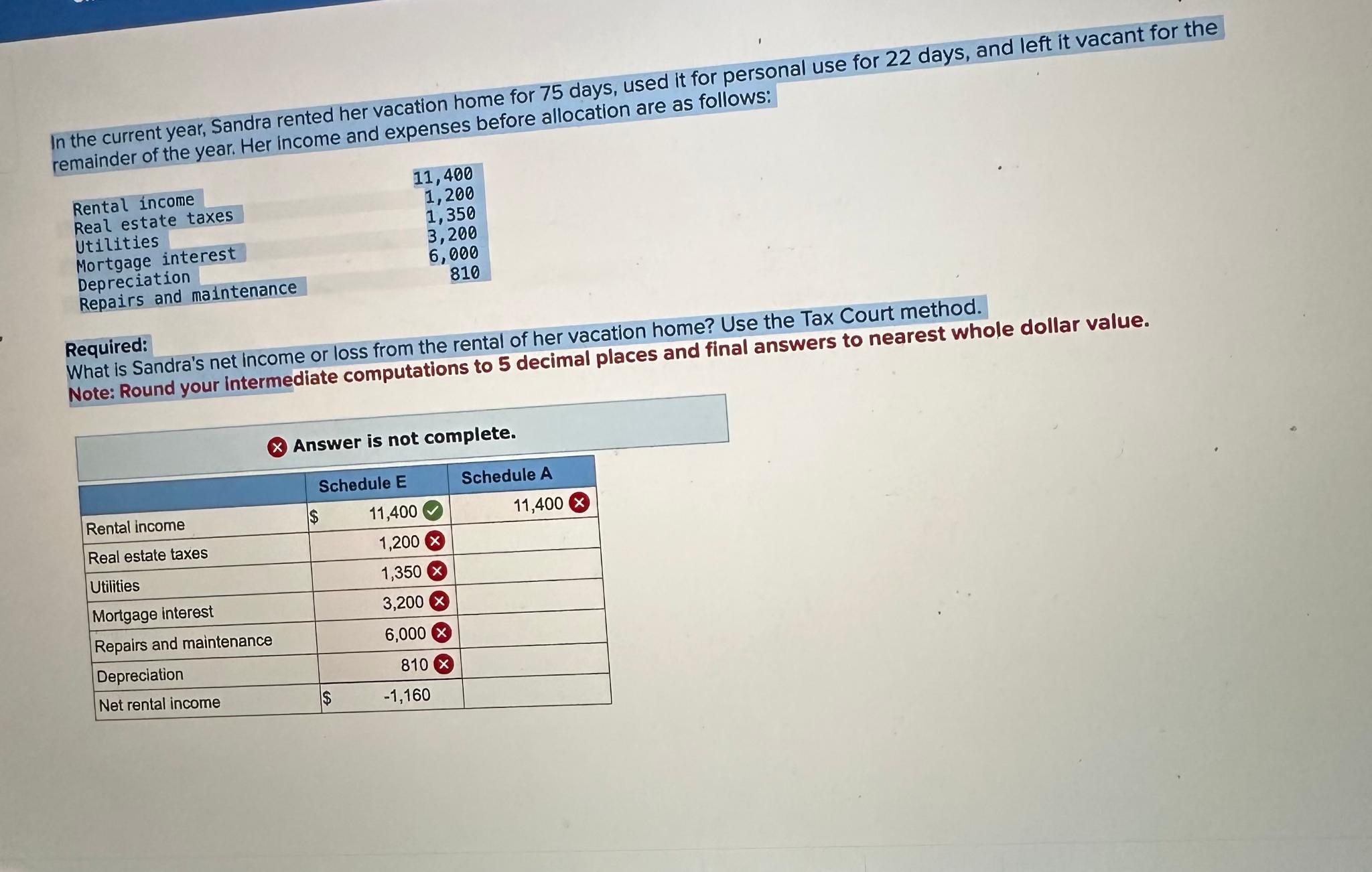

Solved In the current year Sandra rented her vacation home for 75

Solved In the curfent year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Solved In the current year Sandra rented her vacation home Chegg com

Answered: the current year Sandra rented her bartleby

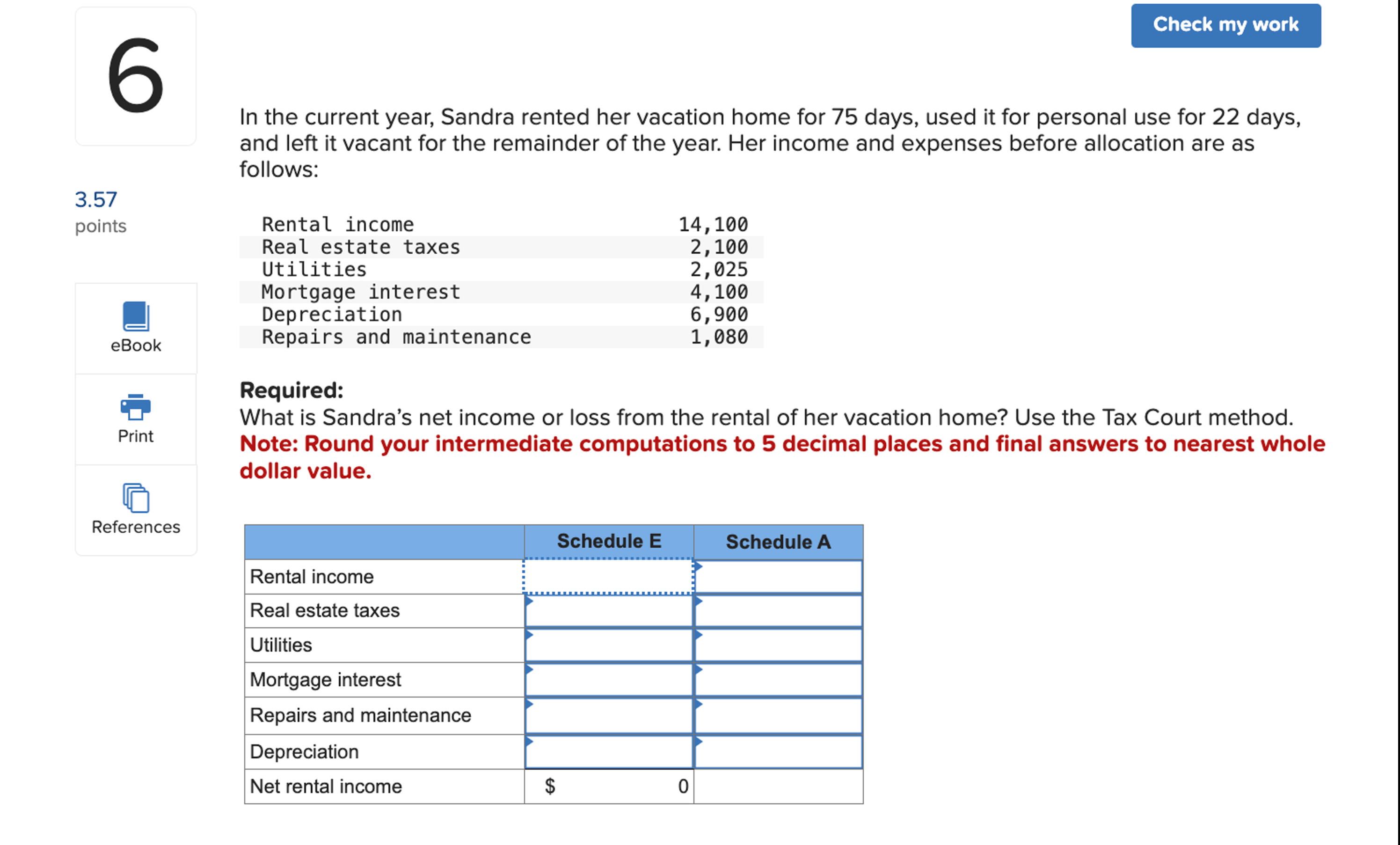

Solved 3 57 In the current year Sandra rented her vacation Chegg com

Answered: In the current year Sandra rented her bartleby

Answered: In the current year Sandra rented her vacation home for 75

Answered: Problem 8 35 (LO 8 2) In the current bartleby

What Is The Tax Court Method? CountyOffice org YouTube

Is Verbal Abuse Domestic Violence? CountyOffice org YouTube

LISTEN LIVE: Supreme Court hears case on LGBTQ storybooks and public

LISTEN LIVE: Supreme Court hears case on LGBTQ storybooks and public

LISTEN LIVE: Supreme Court hears case on LGBTQ storybooks and public

LISTEN LIVE: Supreme Court hears case on LGBTQ storybooks and public

LISTEN LIVE: Supreme Court hears case on LGBTQ storybooks and public

LISTEN LIVE: Supreme Court hears case on LGBTQ storybooks and public

LISTEN LIVE: Supreme Court hears case on LGBTQ storybooks and public