Tax Court Method Vs Irs Method

Here are some of the images for Tax Court Method Vs Irs Method that we found in our website database.

Tax reliefs Available Under the Personal Income Tax Act Taxaide

Record surge in Advance Tax collection for Direct Tax signals economic

When Is Tax Season? Start Date and How To File Early

Taxpayer #39 s guide to your 2023 taxes Brigit Blog

The Ultimate Guide To Tax Keka

Old tax regime vs new tax regime what is income tax rate under old tax

Income Tax department launches online chat to answer taxpayers

)

As interim Budget nears check differences between old and new tax

D1 Tax Code Tax Codes Explained RIFT

check tax documents Income tax filing refund and payment concept flat

Understanding The Key Differences: Corporation Tax vs Income Tax

Como Calcular Taxes De Un Producto Printable Templates Free

Demystifying Income Tax Return (ITR) Filing: A Complete Tutorial

Curso de Income Tax para Principiantes Centro Latino de Capacitacion

What are Taxes Taxation: A Guide to Understanding Taxes with Your Tax

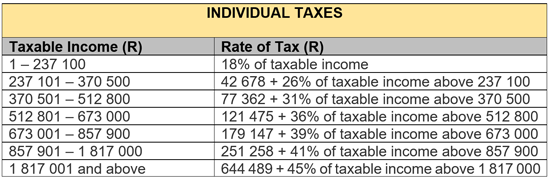

Tax Rates Archives Conner Ash

Key tax changes to be aware of from 1 April Blue Spire Accountants

Salaried group: calculate your income tax for FY24 here Business

2021 tax brackets irs head of household ponwolf

2021 az income tax brackets usaress

Budget 2023: Your Tax Tables and Tax Calculator Amods Accounting

Basic Concepts or Terms of Income Tax Free BCom Notes

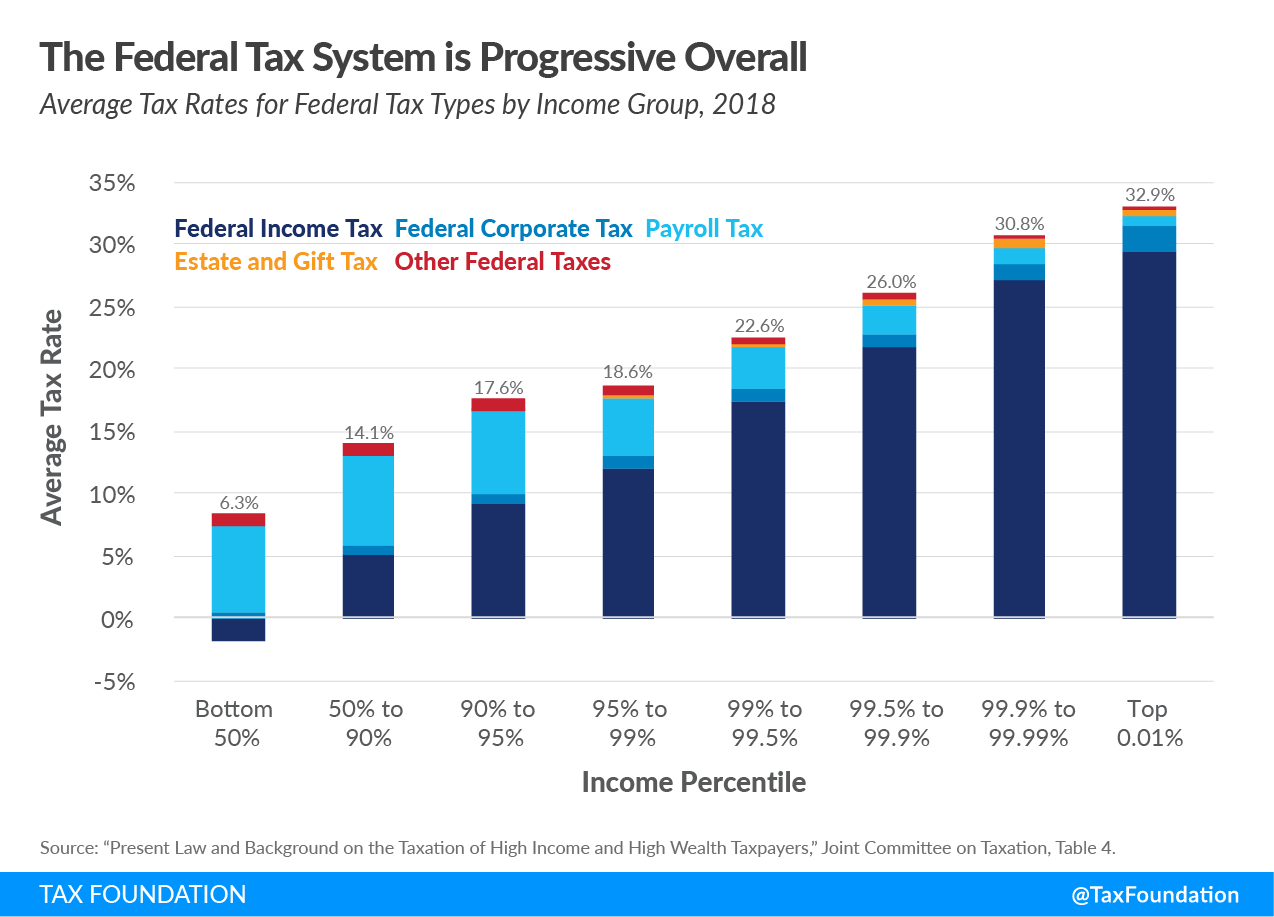

Are Federal Taxes Progressive? Taxes Transfers Tax Foundation

New York State Income Tax Standard Deduction 2024 Chad Meghan

the tax deductions master list

Income Tax Deductions For Fy 2023 24 New Regime Printable Forms Free

New Tax Information For 2024 Zena Vickie

2025 Federal Income Tax Brackets: Updated Rates And Considerations

Types of Taxes: The 3 Basic Tax Types Tax Foundation

Tax filers can keep more money in 2023 as IRS shifts brackets Andrews

Us Tax Brackets 2025 Chart Calculator Bernie Lianne

Summary of the Latest Federal Income Tax Data 2020 Update

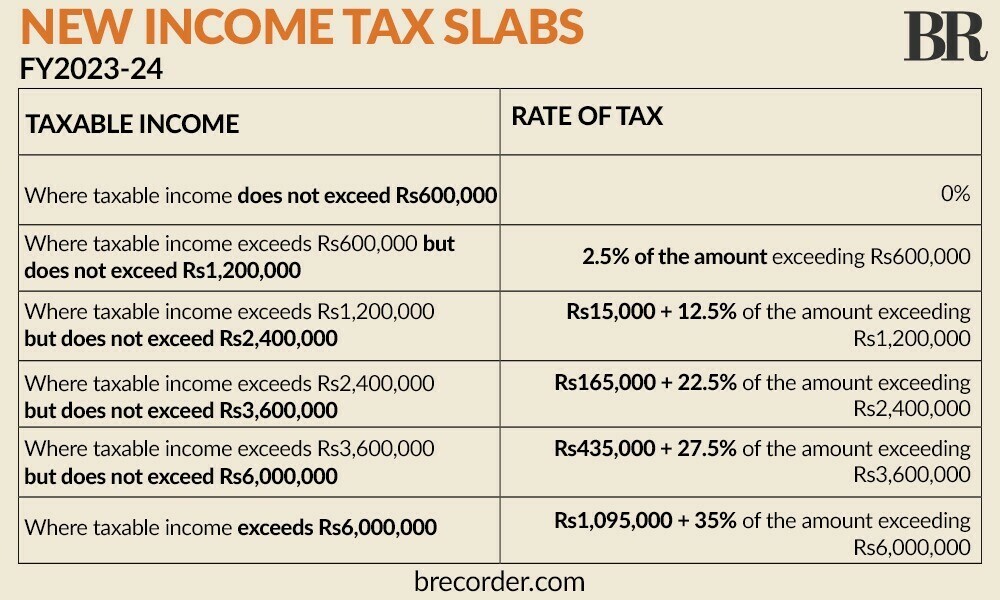

Know the New Income Tax Slab Rates for FY 2023 24 (AY 2024 25

Summary of the Latest Federal Income Tax Data Tax Foundation

Budget FY24: Use our calculator to find out how much tax you will pay