Tax Court Vs Irs Method

Here are some of the images for Tax Court Vs Irs Method that we found in our website database.

Hunter Biden sues IRS tax office for violating privacy

Please use TAX COURT METHOD not Irs method Chegg com

Supreme Court of Florida The Case of Brayshaw #39 s vs Agency of

State Tax Liens vs IRS Tax Liens: What s the Difference? Optima Tax

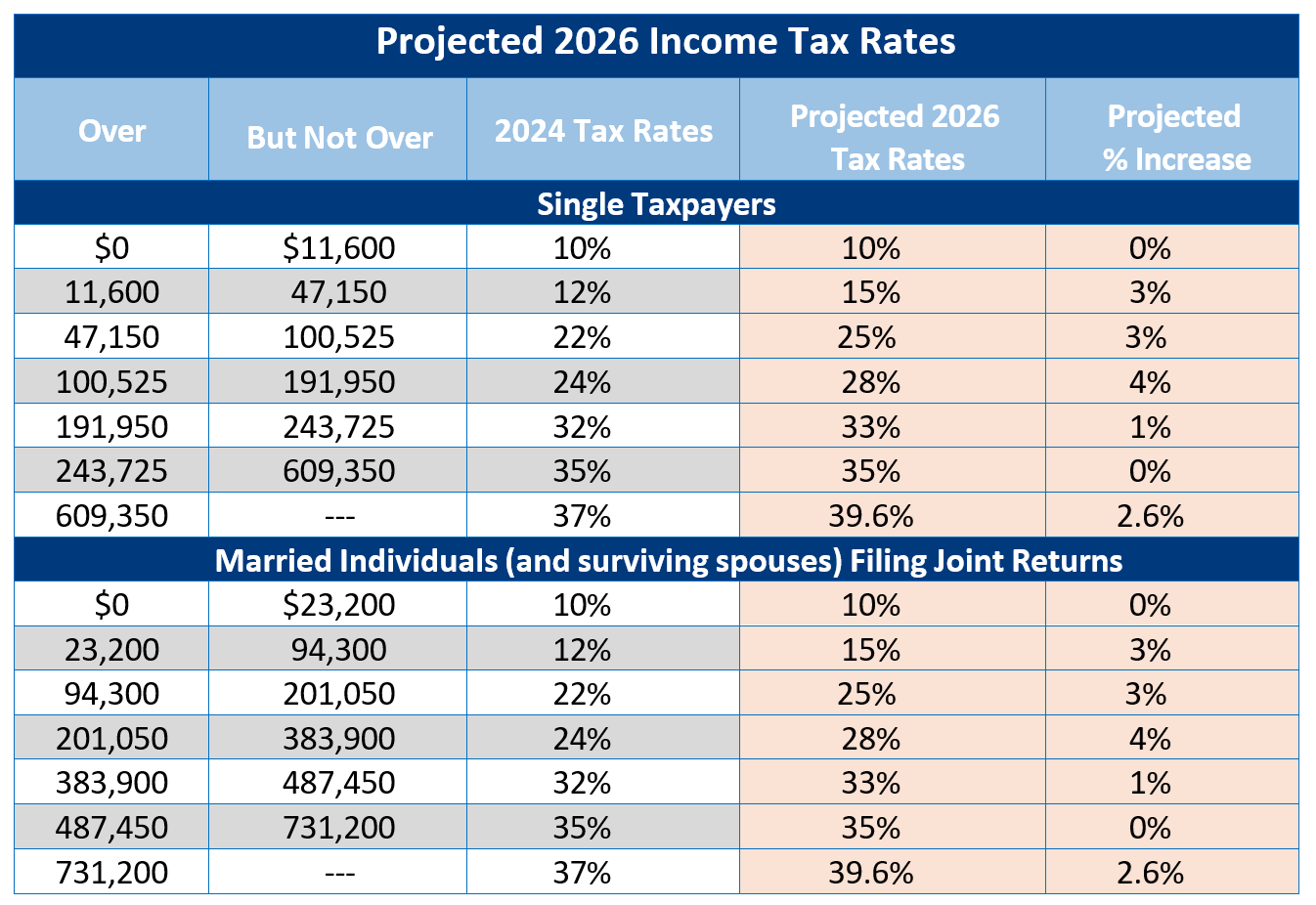

Irs 2026 Tax Brackets Vs 2025

Amazon vs IRS PDF Business Accounting Finance Business

Court Clarifies Tax Treatment of Loyalty Programs Houston Tax

Written by Diane Kennedy CPA on June 19 2023

Tax Court Strikes Down IRS Rules on Land Conservation Deals WSJ

Tax Court Invalidates IRS Assessment Authority for Penalties For

Tax refund method : r/IRS

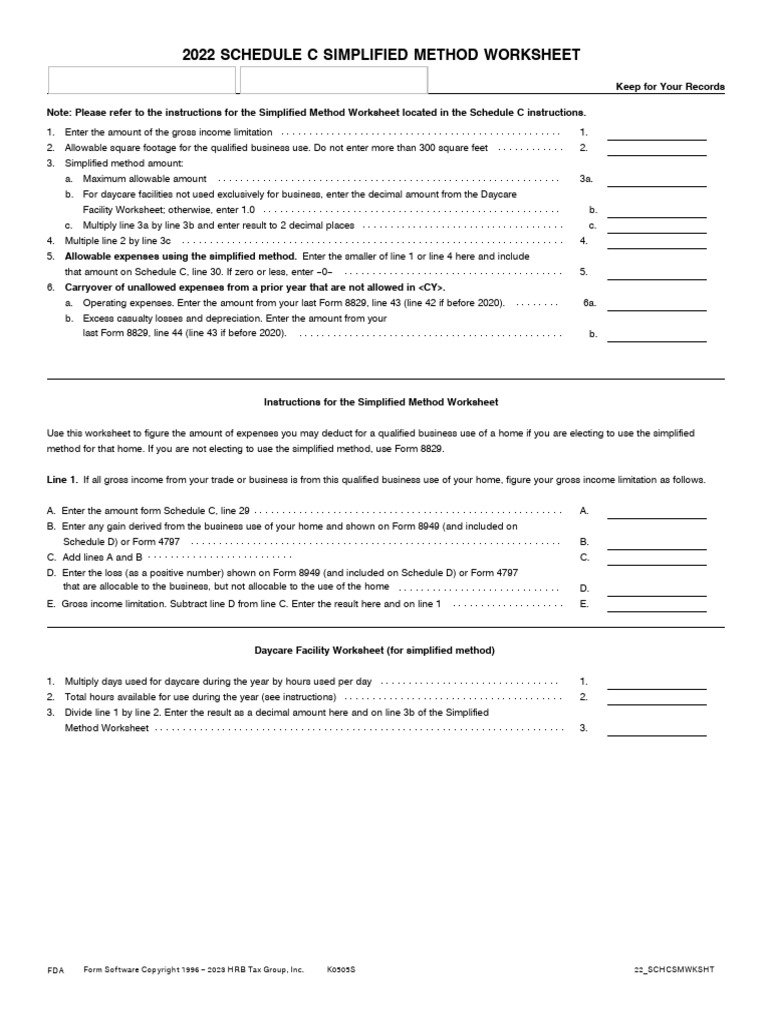

2022 Schedule C Simplified Method Worksheet fillable PDF Irs Tax

Medtronic s IP Pricing Should Adhere to IRS Method US Argues

Tax Court Rebuts IRS Ability to Assess Penalty Following Failure to

Coca Cola Owes $6 Billion to IRS Tax Court Rules WSJ

IRS wants court to toss crypto exec s appeal over bank record summons

Josh Webskowski CFP® on LinkedIn: IRS vs You Taking The Fight To Court

Unlock FREE Tax Filing: VITA vs IRS Free File vs AARP Noel

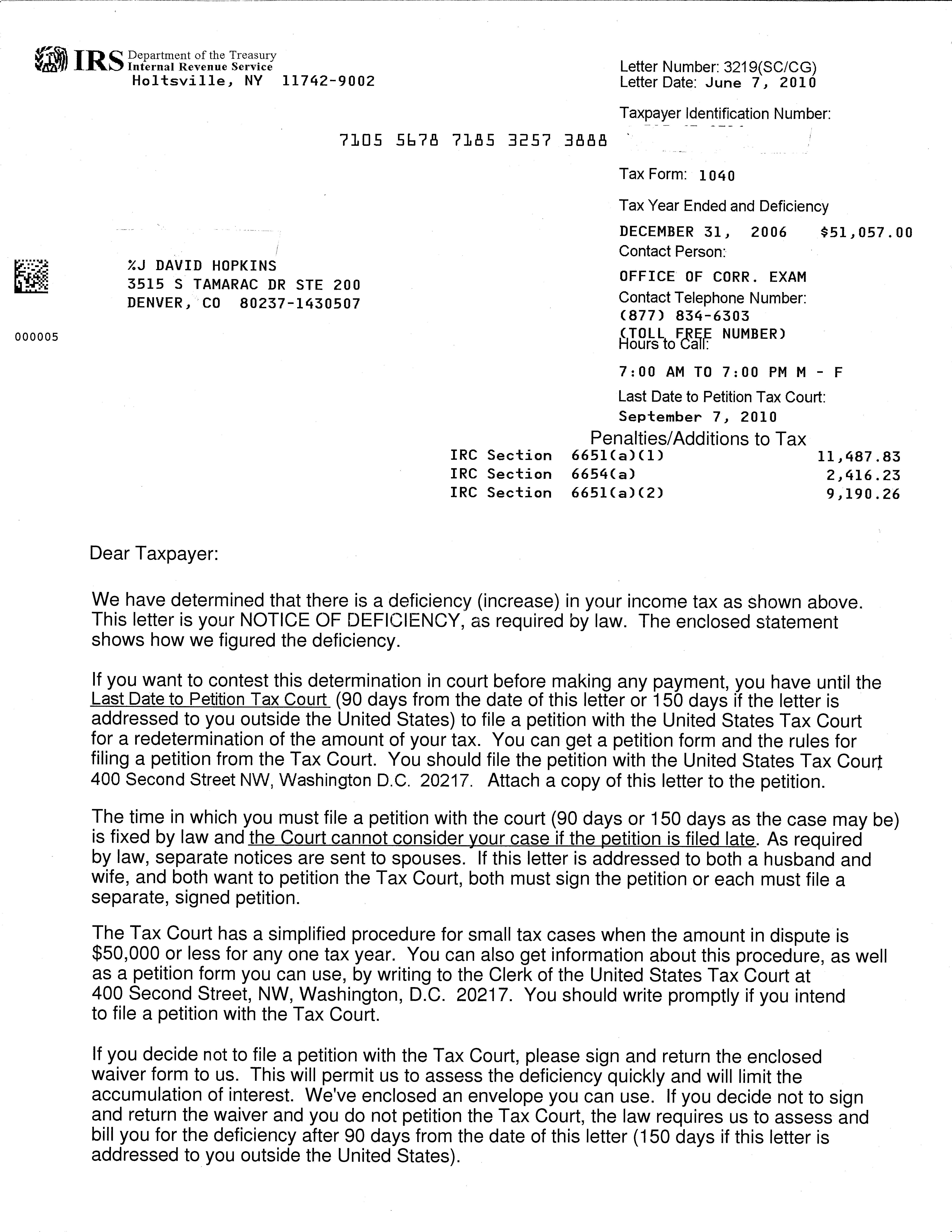

Audit Letter 3219 Tax Attorney Response to the IRS TaxHelpAudit com

IRS Hot Button: Deductible Management Fees vs Disguised Distributions

Dominick Concilio on LinkedIn: Taxpayer vs IRS

IRS Prevails in Supreme Court Case Holding That Redemption Obligation

Supreme Court Rules 9 0 for IRS Denying Refund in Estate Tax Dispute

IRS Inflation Adjustments Taxed Right

ROI vs IRS Cost : r/economy

IRS Releases Guidance on New Transfer Pricing Method BDO

Stephanopoulos slams Scalise for CBO doubletalk on funding Israel vs

US court grants IRS request to probe clients of offshore finance giant

Supreme Court Case and IRS Broker Rule Redefine Crypto Tax

TurboTax vs IRS Transcript Does this mean my returns haven #39 t

IRS Updates Procedural Guidance on Section 174 Accounting Method

IRS installment agreement: 7 Powerful Ways to Win in 2025

TurboTax vs IRS Free File: A Freelance Writer Picks A Winner Bankrate

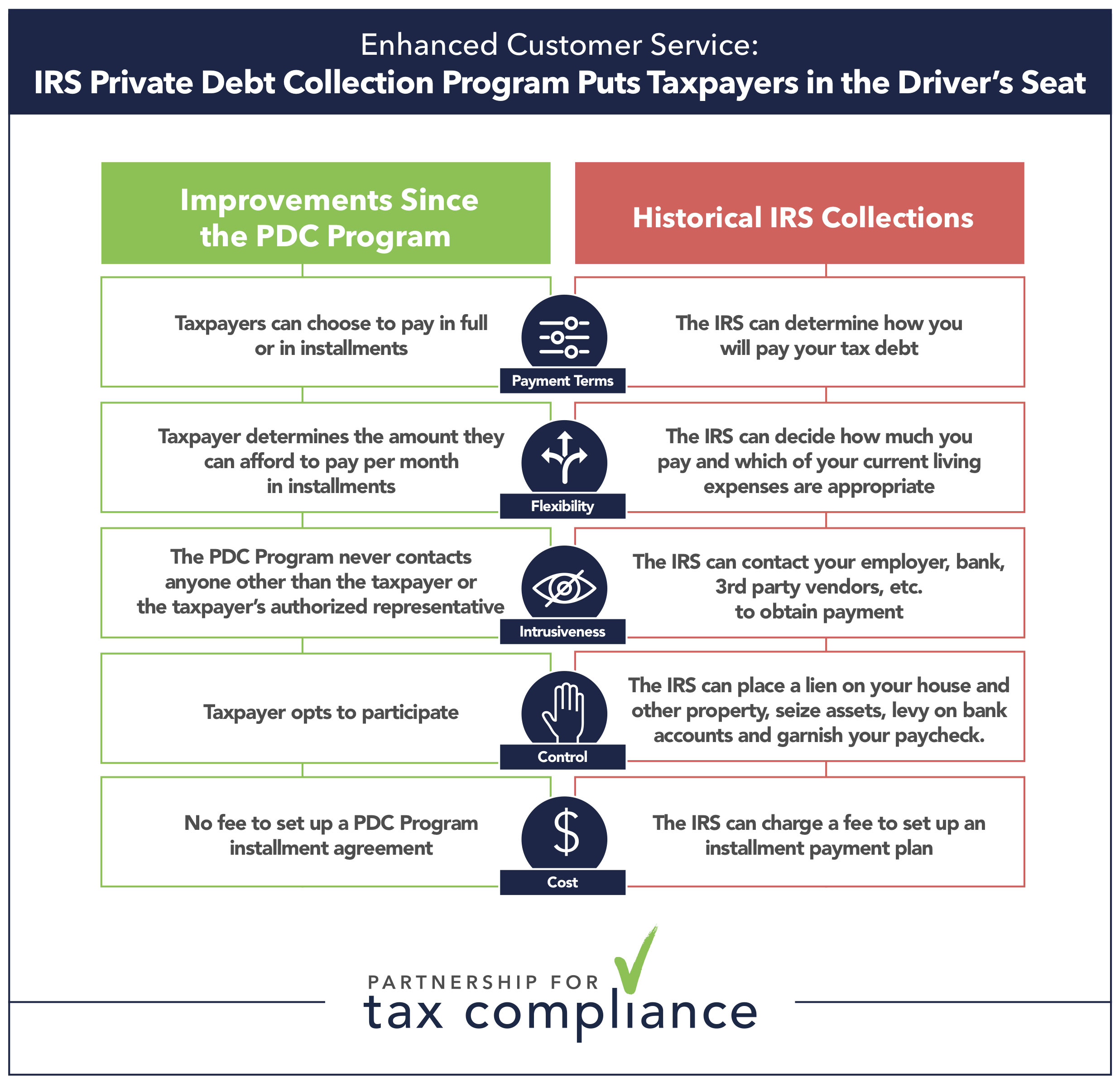

Facts Data Partnership for Tax Compliance

Hedge fund billionaire drops suit vs IRS over tax leak as agency

Couple s Tax Deficiency Suit Partly Barred as Brought Too Late

USA: Key Transfer Pricing Ruling in Facebook vs IRS Case TPC Group

California Estimated Tax Penalties Guide for Business Owners

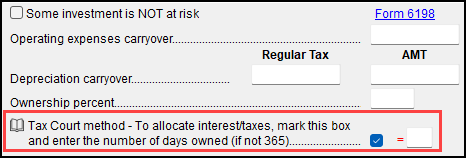

Drake Tax 1040 Schedule E Tax Court Method Election

Peace Of Mind Tax Help Under Section 6330(d)(1) Boechler had 30 days

1040 Schedule E Tax Court Method Election Worksheets Library

2024 2025 Tax Refund Calendar

Eaton Corporation vs IRS: Transfer Pricing Dispute Prof Dr Daniel

Coca Cola vs IRS: Landmark Transfer Pricing Dispute Prof Dr Daniel

Coca Cola vs IRS: Landmark Transfer Pricing Dispute Prof Dr Daniel

Coca Cola vs IRS: Landmark Transfer Pricing Dispute Prof Dr Daniel

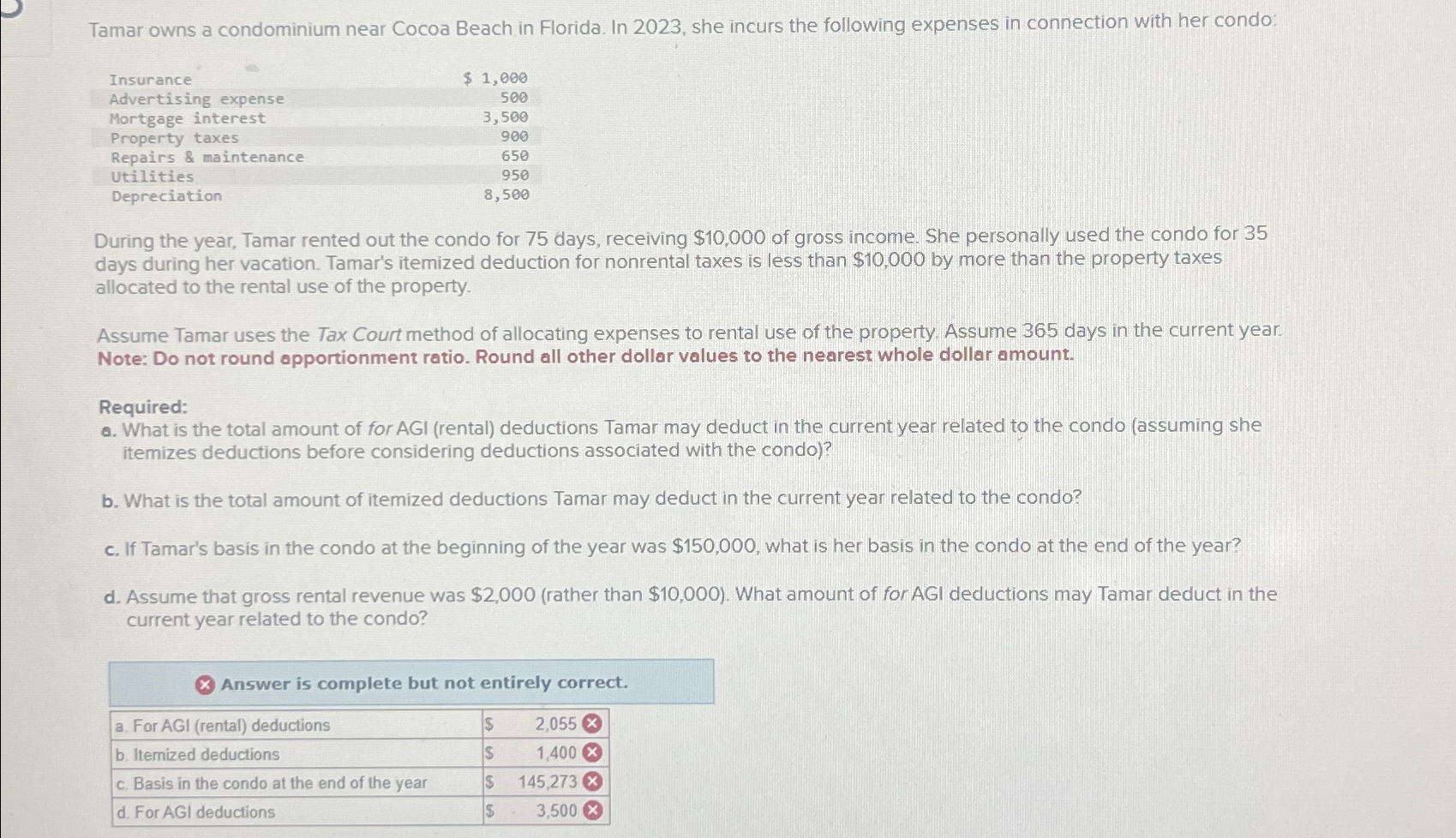

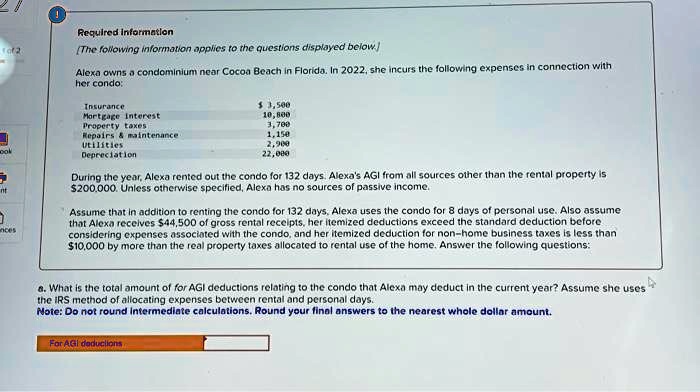

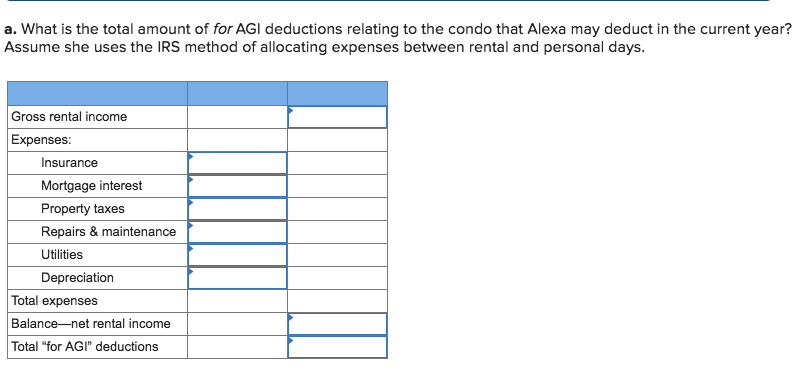

a What is the total amount of for AGI deductions relating to the condo

Claiming Mileage With The IRS Actual Expense Method in 2025

3M Opinion: The Tax Court s Evolving View of the Administrative

Commodore VR/VS (IRS) with VT VZ front Standard rear SAFEBRAKE

Difference Between Tax Attorney CPA Who s Best?

Solved Required informatio The following information Chegg com

Vacation home rentals and the TCJA Journal of Accountancy

FIFO LIFO HIFO Crypto Tax Guide: IRS Rules Gains and 2025 Tips

A recent case from the US Supreme Court could affect you if you are a

Nike fighting $223 million foreign tax credit bill Don #39 t Mess With Taxes

Kenndal D Crawford 109 Inwood Court Spartanburg SC 29302: Employer Use

Dan VS IRS YouTube

VIRGIL VS IRS (EXTREME RULES IRONMAN) YouTube

Irs Tax refund/method/sauce YouTube