U S Tax Court

Here are some of the images for U S Tax Court that we found in our website database.

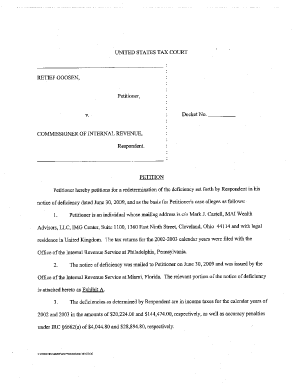

02 02 2023 Us Tax Court Motion Stay Proceeding Case No 23105 18 W

U S Tax Court Greenroofs com

U S Tax Court Greenroofs com

Trimble Admitted to U S Tax Court Sprouse Shrader Smith

Medtronic III U S Tax Court attempts to bridge the gap ? NovioTax

U S Tax Court Records PACER Case Search UniCourt

Us Tax Court Wadaef

Introduction to the U S Tax Court

IRS Tax Court: Standing up to the IRS Law Offices of Daily Montfort

How Long Do U S Tax Court Trials Take?

The quot Non Suit quot in U S Tax Court Cases Houston Tax Attorneys

Crazy Tax Court Cases This is True

Judge Tamara W Ashford of the U S Tax Court: Spring 2025 Fogel

Us Tax Court What Is Tax Court How Does It Work Get Your Irs Tax

The Only Petition at U S Tax Court by Mariette Do Nguyen Goodreads

What is the U S Tax Court? Optima Tax Relief

The Tax Times: Tax Court Says Failure to File Form 3520 Keeps Statute

The U S Tax Court Cryptocurrency and You Brotman Law

U S Tax Court Issues Ruling in Prolonged Dispute Between The Coca Cola

United States Tax Court Reports U S Government Bookstore

The Tax Times: Tax Court Cuts $16 7M Deduction To $93 000 For

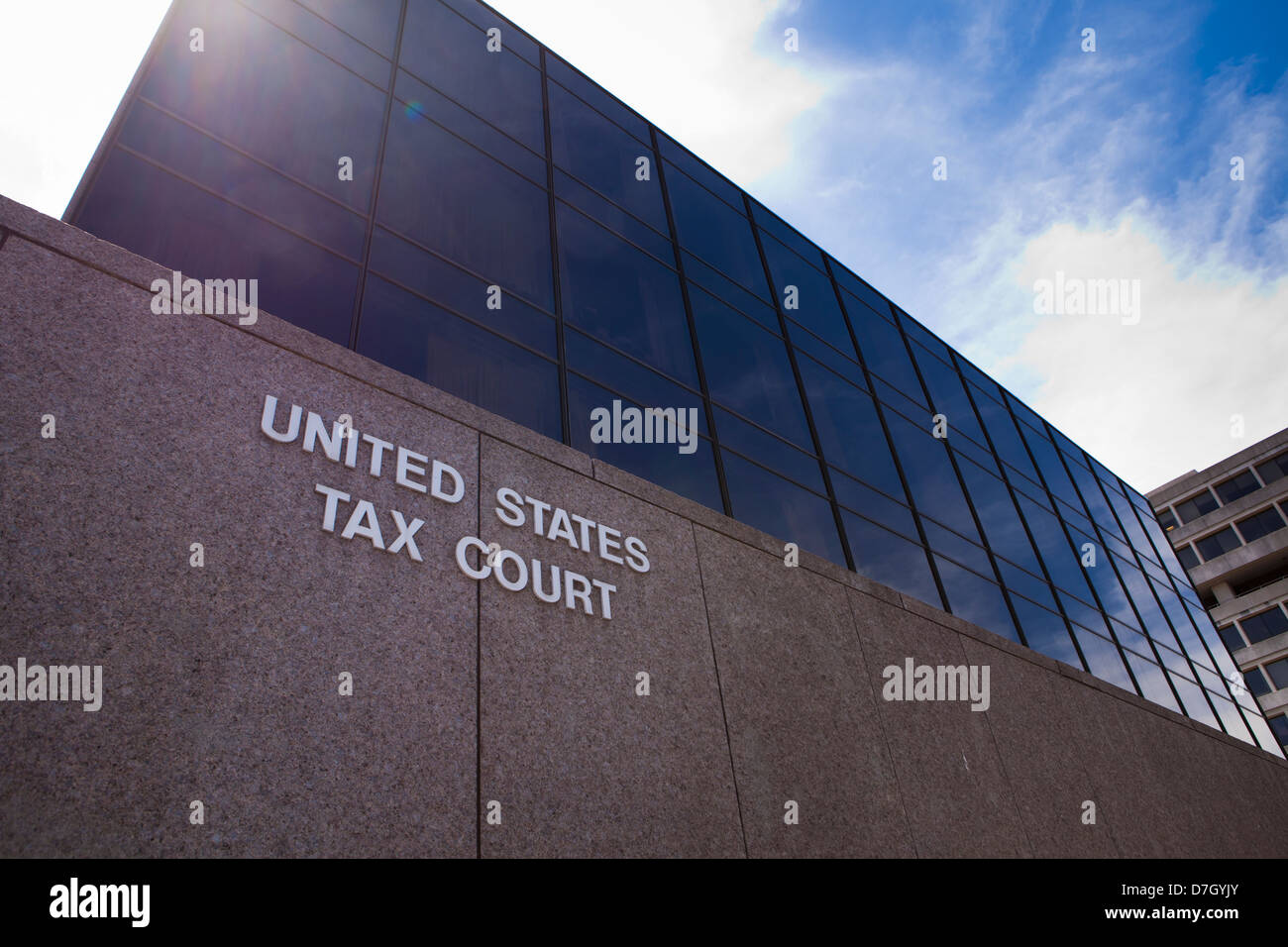

Us tax court building washington hi res stock photography and images

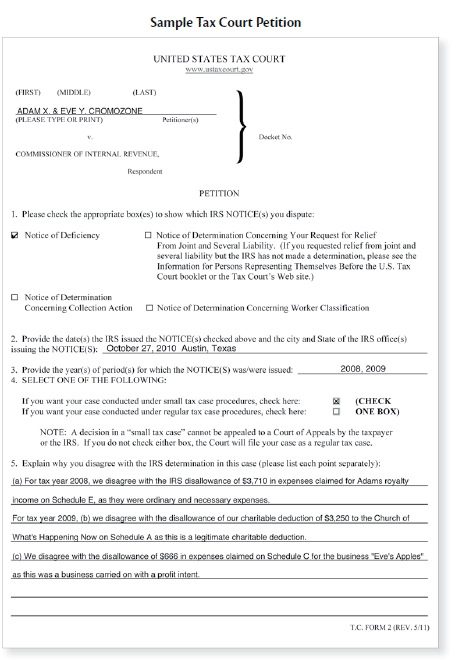

Information About Filing a Case in the U S Tax Court

Facing An Appearance In U S Tax Court For Your Trial? Here Are Some

U S Tax Court Holds Bond Financing Costs Are Includible in LIHTC Basis

Tax Court streamline document filing Accounting Today

Can a U S Tax Court Decision Be Appealed? CPA Practice Advisor

Can a U S Tax Court Decision Be Appealed? CPA Practice Advisor

Can a U S Tax Court Decision Be Appealed? CPA Practice Advisor

Refund Litigation Where District Court differs from Tax Court

Can a U S Tax Court Decision Be Appealed? CPA Practice Advisor

Can a U S Tax Court Decision Be Appealed? CPA Practice Advisor

Tax Court Affirms Mortgage Co #39 s $7M Income For Deduction Law360 Tax

Can a U S Tax Court Decision Be Appealed? CPA Practice Advisor

Can a U S Tax Court Decision Be Appealed? CPA Practice Advisor

Can a U S Tax Court Decision Be Appealed? CPA Practice Advisor

Can a U S Tax Court Decision Be Appealed? CPA Practice Advisor

alliantgroup Celebrates Win for Taxpayers as U S Tax Court Judges Rule

IRC 2036 The Tax Court Yet Again Greenleaf Trust

Information About Filing a Case in the U S Tax Court

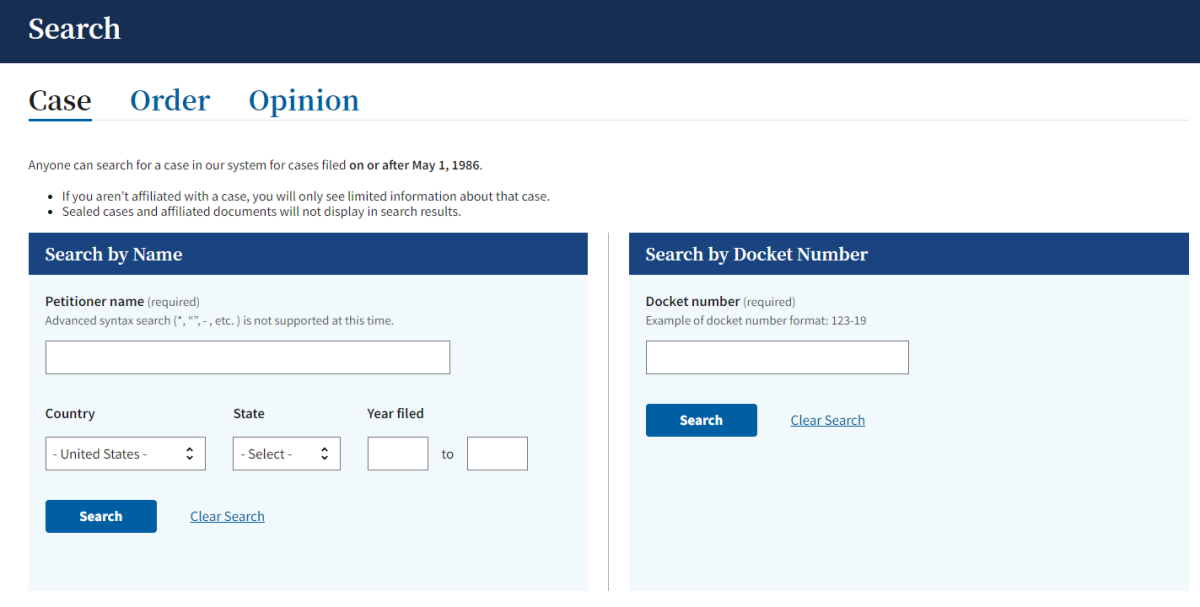

Search U S Tax Court Cases with DAWSON Jenkins Law Library

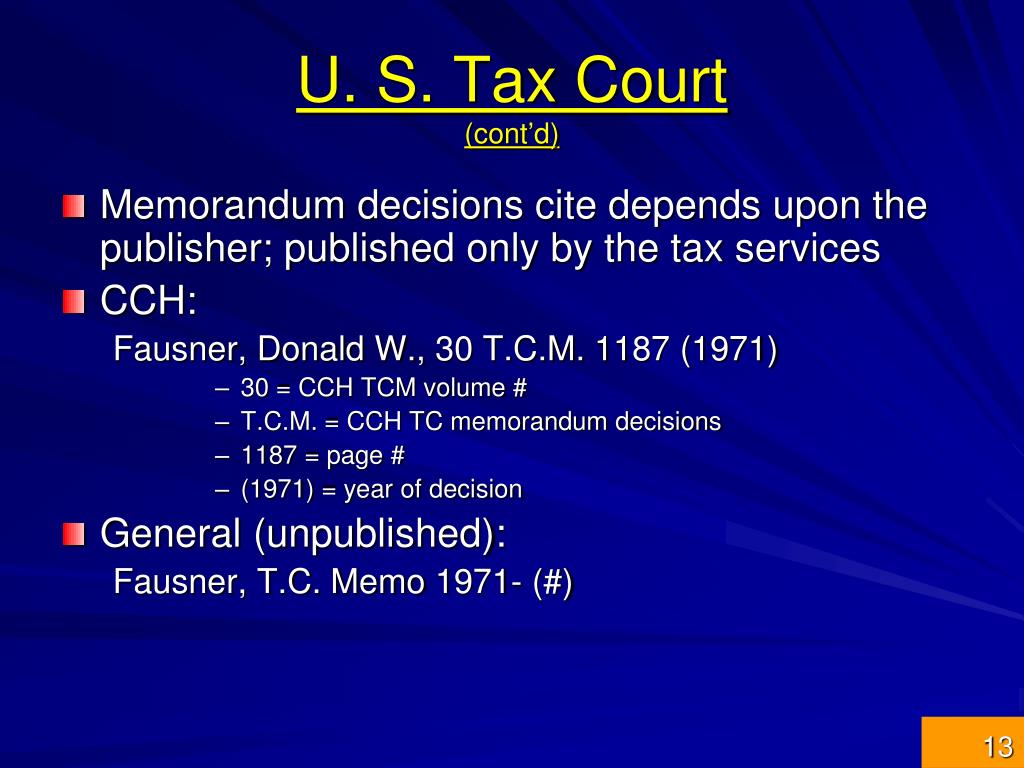

PPT United States Tax Court PowerPoint Presentation free download

PPT United States Tax Court PowerPoint Presentation free download

United States Tax Court in Washington DC Editorial Photography Image

Can a U S Tax Court Decision Be Appealed?

U S Tax Court Podcast Rik Thakrar and Lee Wilson Listen Notes

U S Tax Court Petition Kit Fill and Sign Printable Template Online

Cecil v Comm r: The U S Tax Court Agrees with Taxpayers on Tax

US Tax Court Petition Kit 2018 Fill and Sign Printable Template

The U S Tax Court has ruled a horse breeding and racing activity is a

Tax Court Rules FBAR Penalties Are Not Taxes Limiting Taxpayer Rights

The Importance of Proper Tax Documentation in Tax Deductions Farrell

U S Government Reliance on Income Tax Over the Last 30 Years

Tax Controversies Stout

U S Tax Court: Proving A Net Operating Loss Deduction Carryover

Court Jurisdiction of Tax Issues and Appellate Structure Tax Law

Law Office of Pietro Canestrelli a Tax Controversy Boutique APC At

Law Office of Pietro Canestrelli a Tax Controversy Boutique APC At

18F blog archive 18F Checks In With the DAWSON Project at the U S