Us Tax Court Rules

Here are some of the images for Us Tax Court Rules that we found in our website database.

Tax Court Rules United States Tax Court

Search United States Tax Court

Search United States Tax Court

Search United States Tax Court

Search United States Tax Court

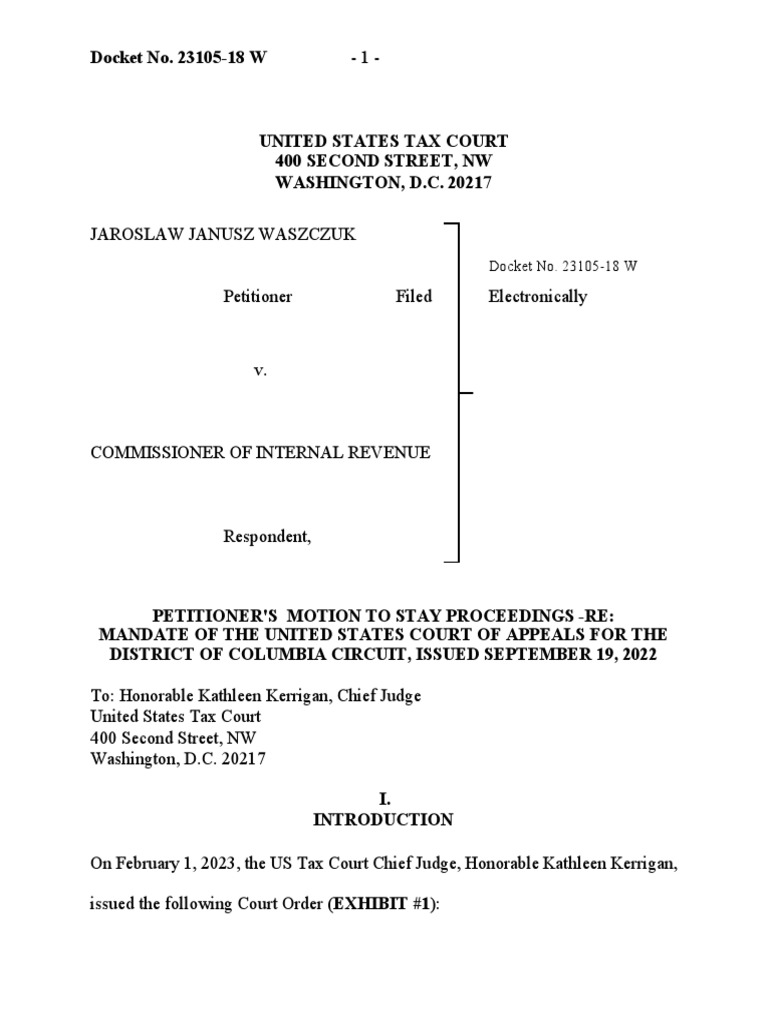

02 02 2023 Us Tax Court Motion Stay Proceeding Case No 23105 18 W

Tax Court Rules Against FLP Analytic Business Appraisers

Introduction to the U S Tax Court

Refund Opportunity: US Tax Court Rules Against IRS on International Tax

Tax Court Rules on Rental Activity Losses iFindTaxPro

Us Tax Court Rules prntbl concejomunicipaldechinu gov co

United States Tax Court Rules of Practice and Procedure

US Tax Court Petition PDF PDFSimpli

US Tax Court rules cannabis deductions are not allowed Investment

US Tax Court rules taxpayer is allowed a DRD for the Sec 78: PwC

US Tax Court Wedding Family Photographer Northern Virginia

Tax Court Rules Farmer Can Use Old Tractors AgWeb

Tax Court Explained: When How to Dispute IRS Decisions

Tax Court Explained: When How to Dispute IRS Decisions

Tax Court Rules: No Deductions for Abandoned Start Up Costs

Tax Court Rules on Facebook Transfer Pricing Rejects IRS Valuation

Tax Court Definition Rules Procedure How Does it Work?

US Tax Court Rules on Self Employment Tax

Jonathan Green on LinkedIn: The US Tax Court Rules the IRS Lacks

US Tax Court Rules on Depreciation Kelley Drye Warren LLP

Tax Court Rules on SE Tax Exemption for Limited Partners CohnReznick

TAX COURT RULES AGAINST IRS ON FORM 5471 PENALTIES Expat Tax

Tax Court Opens Door for Employment Tax Challenge Extensions

Coca Cola Improperly Shifted Profits Abroad US Tax Court Rules

Tax Court rules cancellation of debt is part of gain realization

Tax Court rules cancellation of debt is part of gain realization

Tax Court rules cancellation of debt is part of gain realization

Tax Court rules cancellation of debt is part of gain realization

Tax Court rules cancellation of debt is part of gain realization

Tax Court rules cancellation of debt is part of gain realization

Tax Court rules cancellation of debt is part of gain realization

Tax Court rules cancellation of debt is part of gain realization

Tax Court rules cancellation of debt is part of gain realization

Tax Court rules cancellation of debt is part of gain realization

Tax Court rules cancellation of debt is part of gain realization

Tax Court Rules Against Micro Captive Case Involving Life and Annuity

Webinar: The Trial of a US Tax Court Case Practice Procedure Part I

Tax Court Rules on New Secure 2 0 Limits for IRA Related Penalties

Tax Court Rules IRS Cannot Assess or Collect Penalties for Failure to

Gray Farris on LinkedIn: The US Tax Court has issued a press release

Tax Court Rules in Hallmark Research Collective v Commissioner

US Tax Court Rules in Farhy v Commissioner Tax Natives posted on the

Tax Court Rules in Hallmark Research Collective v Commissioner

Israel Must Recognize Utah Online Marriages Supreme Court Rules AMM Blog

US Maryland Sales and Use Tax Guide VATabout

Oregon Judicial Department : Tax Court Home : Oregon Tax Court : State

3M Opinion: The Tax Court s Evolving View of the Administrative

Tax Court Rules on Employee Benefit Plans UMMAT TAX LAW

Motion For Summary Judgment PDF Summary Judgment Federal Rules Of

How To File A Petition With The US Tax Court? CountyOffice org YouTube

Judicial Branch Chapter ppt download

Latest VAT News and Updates

Key Court Decision: US Tax Court Rules on 2010 Federal Income Course Hero

US Tax Court rules for corporate dividends Valerm Law Group LLC